To Our Unitholders

-

Executive Director

Daiwa House REIT

Executive Director

Daiwa House REIT

Investment Corporation -

President and CEO

Daiwa House Asset

President and CEO

Daiwa House Asset

Management Co., Ltd.

We would like to report on the financial results and give an overview of operations of Daiwa House REIT Investment Corporation (hereinafter referred to as “DHR”) in the 35th fiscal period ended August 31, 2023.

DHR acquired one hotel property (acquisition price of approximately ¥3.1 billion) in March 2023. DHR disposed of one residential property (disposition price of approximately ¥1.0 billion), recording a gain on sales of approximately ¥0.3 billion. As a result, DHR’s portfolio as of the end of the current fiscal period consisted of 230 properties with an asset size of ¥897.5 billion (total acquisition price). Our occupancy rate at the end of the current fiscal period was 99.6%. In addition, DHR acquired one hotel property (acquisition price of approximately ¥5.1 billion) in September 2023 and one logistics property (acquisition price of approximately ¥3.1 billion) in October 2023, both of which fall in the following fiscal period.

Regarding the Japanese economy, economic activity continues to normalize on account of the easing of restrictions against the spread of COVID-19. Meanwhile, we must be aware of the future impact on economic activities of factors including the impact of risk of a rise in interest rates due to changes to the monetary easing policy by the Bank of Japan, the world’s central banks raising interest rates, the risk of economic slowdown because of a downturn in overseas economies, stagnation in the real estate market in China, and surging resource prices.

DHR will work to continuously improve unitholder value by ensuring stable revenue and steady growth of its portfolio over the medium to long term through full utilization of its sponsor Daiwa House Group’s comprehensive strengths and knowhow regarding real-estate development.

In closing, we ask for the continued support of our unitholders and the investment community as we move forward.

Financial Highlights

Distributions

-

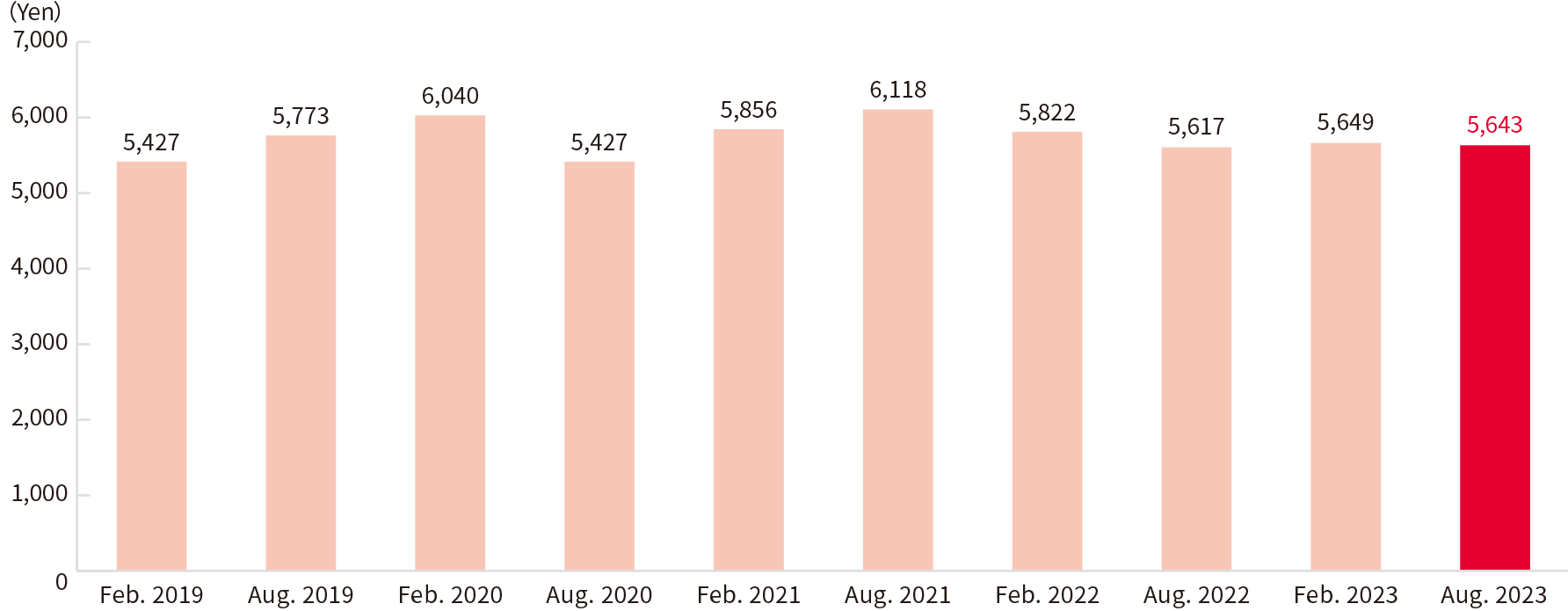

Distributions per Unit(Note 1)

- 35th Fiscal Period

-

¥ 5,643

(From March 1, 2023 to August 31, 2023)

*Distribution payments start date is November 13, 2023. -

Forecast Distributions per Unit(Note 2)

- 36th period

-

¥ 5,650

(From September 1, 2023 to February 29, 2024)

- 37th period

-

¥ 5,650

(From March 1, 2024 to August 31, 2024)

- Distributions per unit for the fiscal period ended August 31, 2023 include distributions in excess of earnings of ¥802 (which do not apply to return of capital).

- Forecast distributions per unit are as of October 18, 2023, and actual distributions per unit may vary from the forecast. Furthermore, these forecasts do not guarantee the amount of distributions. In addition, distributions per unit include distributions in excess of earnings, and we forecast distributions in excess of earnings per unit of ¥854 (including return of capital of ¥45) for the fiscal period ending February 29, 2024 and ¥846 (including return of capital of ¥32) for the fiscal period ending August 31, 2024.

Distributions per Unit

Enlarge image

Operating Results

| Fiscal period ended February 28, 2023 |

Fiscal period ended August 31, 2023 |

|

|---|---|---|

| Operating revenues | ¥29,489million | ¥29,920million |

| Operating income | ¥12,740million | ¥12,914million |

| Net income | ¥11,123million | ¥11,224million |

-

- Asset size

(acquisition price basis) -

¥ 897.5 billion

- Asset size

-

- Period-end occupancy rate

-

99.6 %

-

- LTV

(excluding goodwill) -

44.9 %

- LTV

-

- Credit rating

-

JCR: AA (Stable)R&I: AA- (Stable)

Initiatives to Pursue Growth

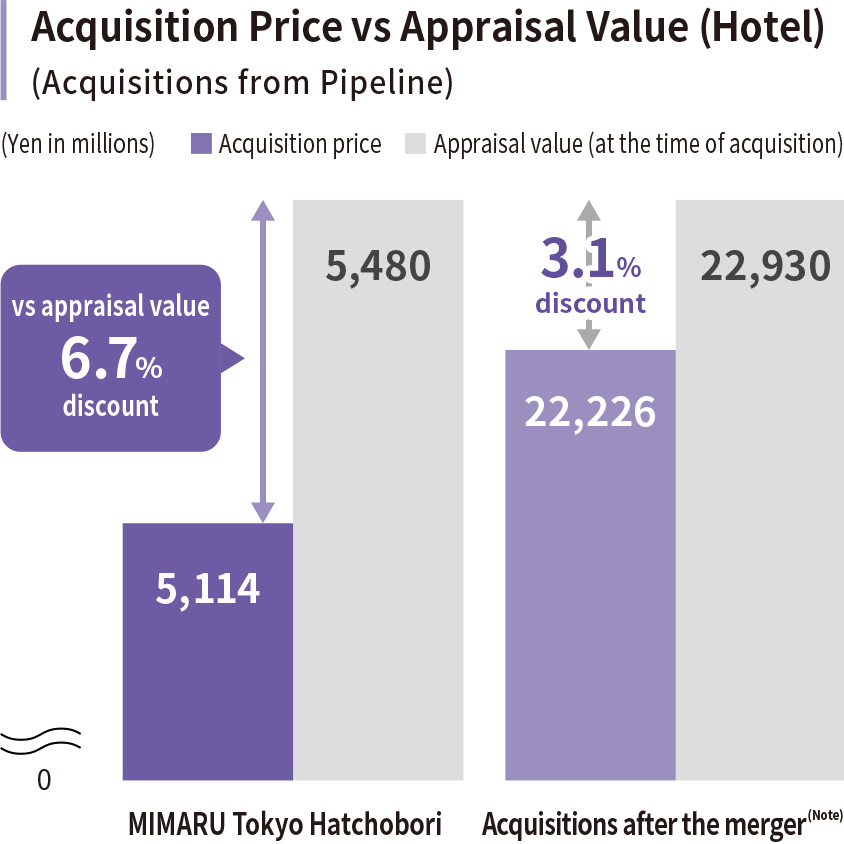

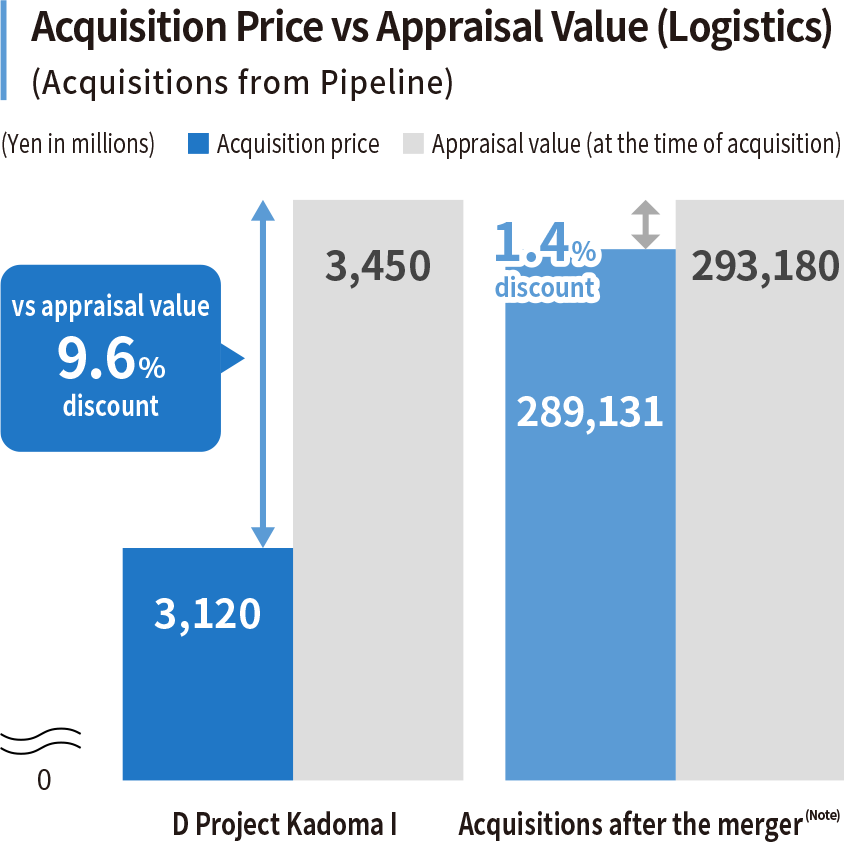

Continued Strong Support from Sponsor (New Acquisitions)

- Acquired MIMARU Tokyo Hatchobori and D Project Kadoma I from pipeline of Daiwa House Group

- Both acquired at a larger discount to appraisal value compared to the past acquisitions

MIMARU Tokyo Hatchobori

| Location | Chuo Ward, Tokyo |

|---|---|

| Construction date | February 27, 2019 |

| Acquisition price | ¥5,114 million |

| Appraisal value | ¥5,480 million |

| Acquisition date | September 1, 2023 |

| NOI yield | 4.0% |

| NOI yield after depreciation | 3.4% |

| Land / Building | Ownership |

| Tenant | Cosmos Initia Co., Ltd. |

D Project Kadoma I

| Location | Kadoma City, Osaka |

|---|---|

| Construction date | February 15, 2019 |

| Acquisition price | ¥3,120 million |

| Appraisal value | ¥3,450 million |

| Acquisition date | October 2, 2023 |

| NOI yield | 6.4% |

| NOI yield after depreciation | 3.5% |

| Land / Building | Fixed-term land lease right and fixed-term sublease right / Ownership |

| Tenant | YOSHINOYA HOLDINGS CO., LTD. |

- “Acquisitions after the merger” refers to the total of the property acquisitions from pipeline of Daiwa House Group after the merger of DHR (September 2016) to the fiscal period ended August 31, 2023.

Secondary Offering by Daiwa House (September 2023)

- Daiwa House sold some of DHR investment units to improve capital efficiency upheld in its Medium-Term Management Plan

- Daiwa House also announced its policy to continue to hold the remaining holdings after the secondary offering and to maintain its support for DHR as the sponsor

Summary of the Secondary Offering

| Seller | Daiwa House Industry Co., Ltd. |

|---|---|

| Offering structure | Secondary offering with overseas marketing (Regulation S only) |

| Launch date | August 31, 2023 |

| Delivery date | September 14, 2023 |

| Markets where investment units were offered | Domestic and EURO markets (Regulation S) |

| Offering size | Approximately ¥25.6 billion |

| Number of investment units sold | 100,000 units (including 5,000 units sold through overallotment) |

| Number of investment units held by Daiwa House after the Secondary Offering | 91,200 units Lockup period: 1 year, % of holdings: 3.9% |

Backgrounds of the Secondary Offering by Daiwa House (Sponsor) and its Future Policy

Backgrounds

- Daiwa House sold some of the DHR investment units with the aim to improve capital efficiency for the purpose of evolving a revenue model that realizes sustainable growth upheld in the 7th Medium-Term Management Plan announced in May 2022

- Proceeds from the secondary offering will be allocated to expanding real estate development investment, based on Daiwa House’s financial and investment strategies

- Daiwa House and the Asset Manager discussed sincerely and chose the secondary offering to offer a wide range of investors, including existing unitholders of DHR, fair opportunities for investment and dialogue

Future Policy

- Daiwa House does not plan additional sales and intends to continue to hold 91,200 investment units of DHR after the secondary offering

- Daiwa House’s diversified support for DHR will remain unchanged after the secondary offering, including granting of preferential negotiation rights

- DHR aims to continuously increase unitholder value by leveraging the support which the Sponsor has long been providing

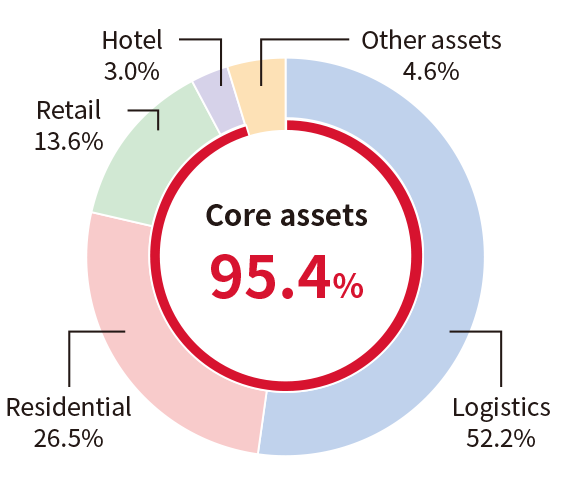

Portfolio

Highlights

Summary

-

- Number of properties

-

232 properties

-

- Asset size

(acquisition price basis) -

¥ 905.7 billion

- Asset size

-

- Logistics

- 67 properties ¥ 473.2 billion

-

- Residential

- 129 properties ¥ 240.3 billion

-

- Retail

- 23 properties ¥ 123.2 billion

-

- Hotel

- 7 properties ¥ 27.3 billion

-

- Other assets

- 6 properties ¥ 41.6 billion

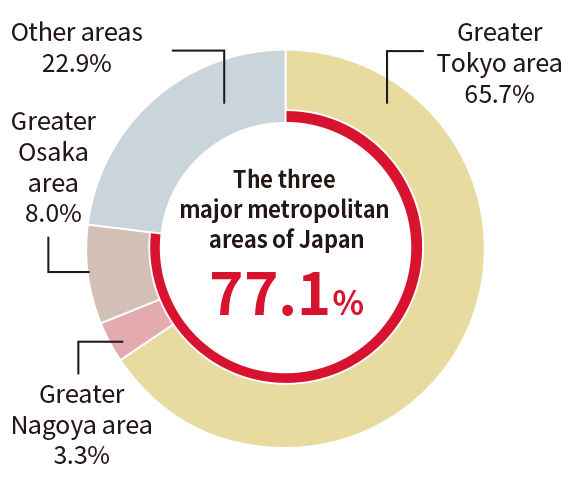

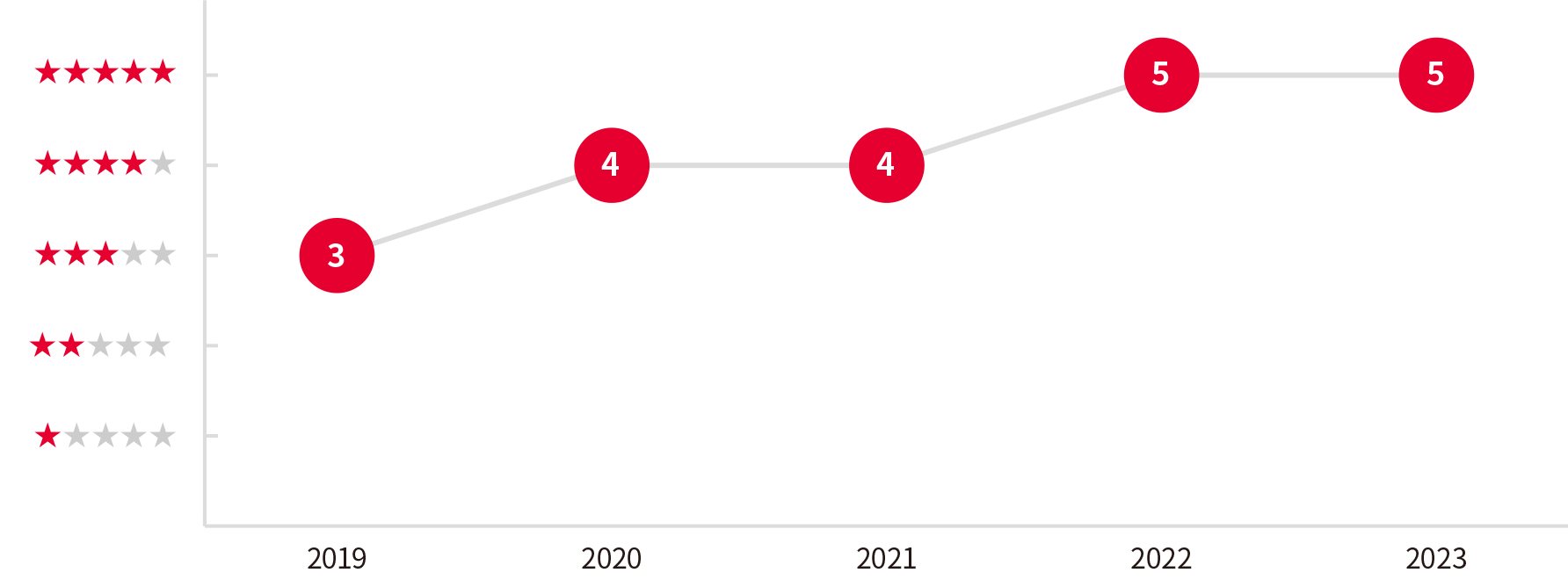

By asset class

By area

By property age

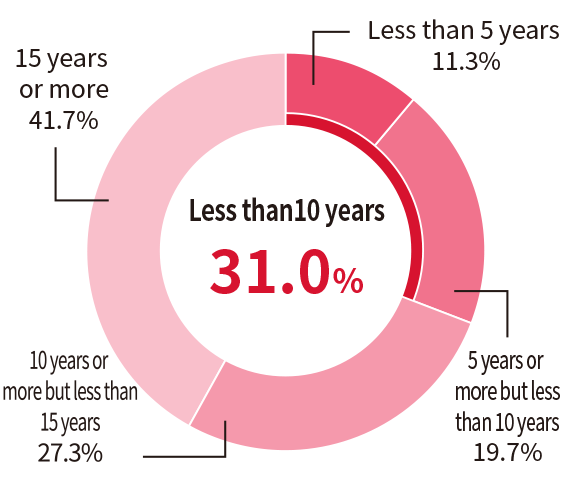

Trends of Asset Size (Acquisition Price Basis) and Occupancy Rate at the End of the Fiscal Period

Enlarge image

ESG Initiatives

Improved External Evaluations by Promoting ESG Initiatives

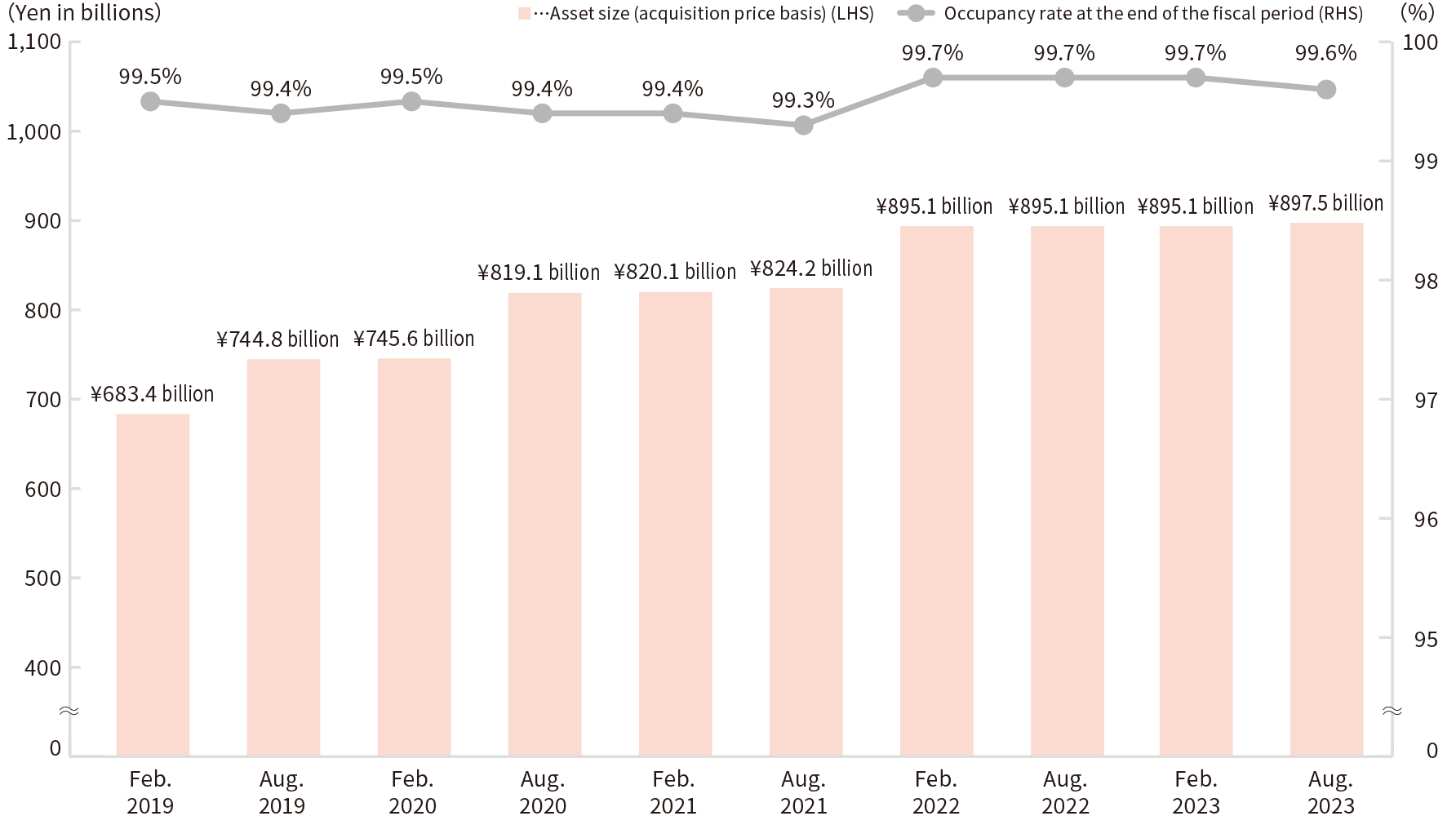

GRESB Real Estate Assessment and GRESB Public Disclosure

- Awarded the highest rating of “5 Stars” for two consecutive years in 2023 GRESB Real Estate Assessment

- DHR was selected as “Global Listed Sector Leader” for the first time (the world’s No. 1 overall score in the listed diversified sector)

- Awarded the highest rating of “A” on a 5-star scale in GRESB Public Disclosure for five consecutive years

GRESB Real Estate Assessment

Enlarge image

Environmental Initiatives

Promotion of Environmental Certification

- 20 properties

- ★★★★★ 7 properties

- ★★★★★ 6 properties

- ★★★★★ 7 properties

- 38 properties

- S 21 properties

- A 16 properties

- B+ 1 property

- 56 properties

- ★★★★★ 14 properties

- ★★★★★ 10 properties

- ★★★★★ 9 properties

- ★★★★★ 16 properties

- ★★★★★ 7 properties

- 8 properties

- “ZEB” 1 property

- ZEB Ready 7 properties

- 1 property

- Certified 1 property

- 1 property

- A 1 property

- 1 property

- 1 property

Social Initiatives

Initiatives Aimed at Social Contributions

Conclusion of “Agreement on Cooperation in Providing Parking Space in the Event of Disasters” with Ome City in Tokyo (FOLEO Ome Imai)

- A portion of the property’s parking space (equivalent to approximately 70 vehicle spaces) is a designated emergency evacuation site for vehicles of the local residents. It will be provided to local residents for free in the event of disasters (linear rainbands, typhoons and other heavy rainfalls, or such events with a potential of occurrence) within the area of Ome City.

- DHR aims to contribute to local communities by collaborating with the local government on storm and flood damage countermeasures, as the property is outside the expected flood zone in the event of storm and flood damage also in the “Ome City Disaster Prevention Map” and suitable as an emergency evacuation site.

Keiichi Hamanaka, Mayor of Ome City

Koichi Tsuchida, President and CEO of the Asset Manager

Investor Information

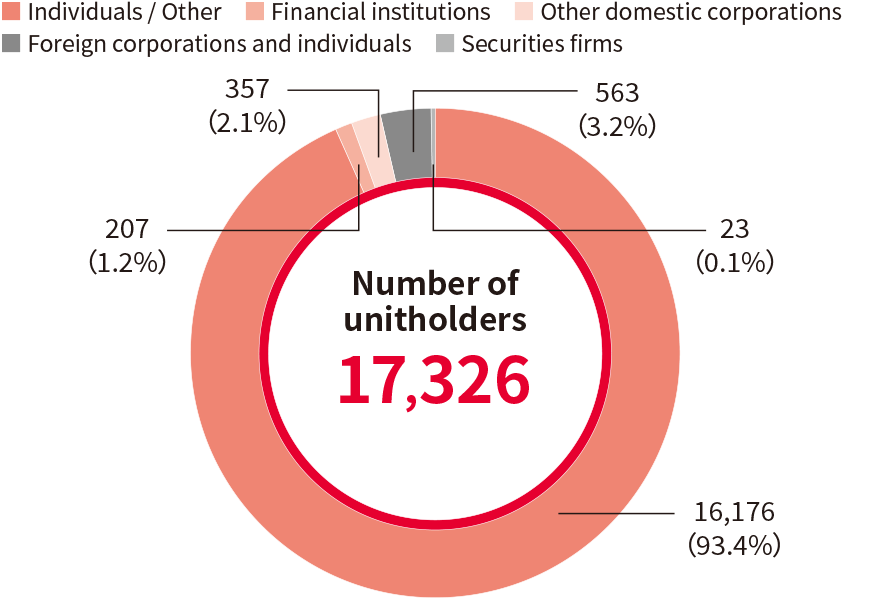

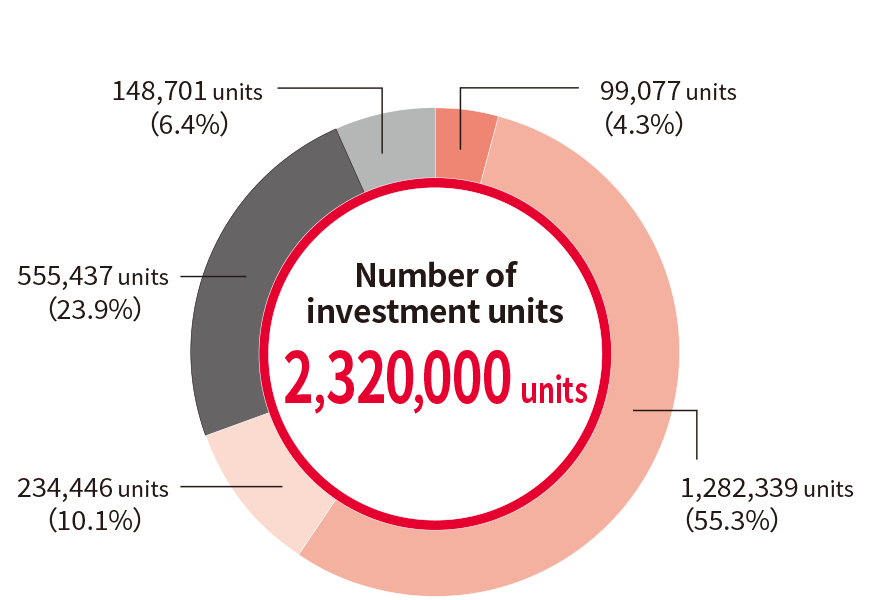

Unitholders Data

- Ratios in parentheses are rounded to the nearest tenth.

Outline of the Asset Manager

| Corporate Name | Daiwa House Asset Management Co., Ltd. |

|---|---|

| Location | 7th Floor, Nissei Nagatacho Building, 2-4-8, Nagatacho, Chiyoda-ku, Tokyo 100-0014 |

| Established | September 1, 2004 |

| Paid-in Capital | ¥300 million |

| Shareholder | Daiwa House Industry Co., Ltd. (100%) |

Note for Unitholders

| Account closing date | Last day of February and August of each year |

|---|---|

| Date for determining distribution payments | Last day of February and August of each year (Distributions are to be paid within three months of each date.) |

| Unitholders’ Meeting | To be held at least once every two years |

| Date for finalizing general meeting voting rights |

Date set forth in Section 16.1 in the Articles of Incorporation by DHR |

| Listing | REIT section of the Tokyo Stock Exchange (Securities code: 8984) |

| Public notices | The “Nikkei” newspaper (Nihon Keizai Shimbun) |

| Transfer agent | 4-1, Marunouchi 1-chome, Chiyoda-ku, Tokyo 100-8233, JAPAN Sumitomo Mitsui Trust Bank, Limited |

| Inquiries |

8-4, Izumi 2-chome, Suginami-ku, Tokyo 168-0063, JAPAN Stock Transfer Agency Business Planning Dept. of Sumitomo Mitsui Trust Bank, Limited TEL: 0120-782-031 (toll-free, available within Japan only) Weekdays 9 a.m. to 5 p.m. |

Procedures for Changes of Address, etc.

Please submit changes of address, name, etc., to your securities company, etc. For procedures regarding investment units registered in special accounts, please contact: Stock Transfer Agency Business Planning Dept. of Sumitomo Mitsui Trust Bank, Limited.

Receipt of Distributions

You can receive distributions when you bring your receipt for distributions to the local office of the Japan Post Bank in Japan or to a post office (bank agent). If the period for receiving distributions has elapsed, please contact the transfer agent Sumitomo Mitsui Trust Bank, Limited.

If you would like to specify an account to which future distributions will be transferred, please follow the procedures of your securities company, etc.

We will not pay and have no obligation to pay cash distributions not claimed within three years of the distribution date, as stipulated in our Articles of Incorporation. Please receive your distributions as soon as possible.

Distribution Statement

The “Distribution Statement” delivered upon payment of distributions includes the “Payment Notice,” referred to in the provisions of the Act on Special Measures Concerning Taxation. This document may be used as a document when declaring income for tax purposes. However, for unitholders who have selected the system of dividend allotment to securities company accounts in proportion to the number of shares held, the amount of withholding tax will be calculated by your securities company, etc. For supporting documents when declaring income for tax purposes, please confirm with your securities company, etc. Furthermore, unitholders who receive distributions by way of a receipt for distributions also receive a “Distribution Statement” enclosed with it.

Outline of the Social Security and Tax Number System Nicknamed “My Number System” with Regard to Investment Units

Residents in Japan are notified of their Social Security and Tax Number (nicknamed “My Number”) by their city, town or village. My Number is required when performing tax-related procedures with regard to investment units.

Use of the My Number for Investment Unit Related Business

As stipulated by laws and regulations, it is now required to state the My Number of the unitholder on payment records that are submitted to the tax office. Unitholders are therefore requested to submit their My Number to their securities company, etc.

[Contact address for inquiries on submitting My Number]

- Unitholders whose investment units are managed by a securities account

Please direct your inquiries to your securities company, etc. - Unitholders not conducting transactions via a securities company

Please call the following toll-free phone number.

Stock Transfer Agency Business Planning Dept. of Sumitomo Mitsui Trust Bank, Limited

TEL: 0120-782-031