To Our Unitholders

-

Executive Director

Daiwa House REIT

Executive Director

Daiwa House REIT

Investment Corporation -

President and CEO

Daiwa House Asset

President and CEO

Daiwa House Asset

Management Co., Ltd.

We would like to report on the financial results and give an overview of operations of Daiwa House REIT Investment Corporation (hereinafter referred to as "DHR") in the 34th fiscal period ended February 28, 2023.

Regarding financial results for the current fiscal period, we achieved a high level of occupancy in our portfolio and continued success at maintaining stable rental revenues. As a result, DHR posted operating revenues of ¥29,489 million, operating income of ¥12,740 million, and net income of ¥11,123 million. The total amount of distributions was ¥13,105 million (¥5,649 per unit). Our occupancy rate at the end of the current fiscal period was 99.7%.

An economic recovery is expected due to restrictions on socioeconomic activities caused by the spread of COVID-19 being relaxed. On the other hand, close attention needs to be paid to the impact on the domestic financial markets from the full-fledged interest rate hikes being implemented by central banks around the world, the risk of a global economic downturn, and higher resource prices.

In the real estate trading market, while the trend of holding off on real estate investment spread due to rising interest rates, the appetite for property acquisition is firm overall among domestic and foreign real-estate investors with regard to prime logistics properties and residential properties, and expected yields on prime properties are trending at low levels. Furthermore, we believe that acquisition and disposition of hotels, etc. will increase in activity in anticipation of the recovery of visitors to Japan in the future.

Under such circumstances, DHR acquired one hotel (acquisition price of approximately ¥3.1 billion) and disposed of one residential property (disposition price of approximately ¥1.0 billion) in March 2023, which falls in the following fiscal period. DHR will work to continuously improve unitholder value, with strategic implementation of the external growth and property replacement that capitalizes on our strength as a diversified REIT.

In closing, we ask for the continued support of our unitholders and the investment community as we move forward.

Financial Highlights

Distributions

-

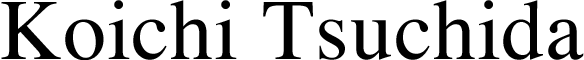

Distributions per Unit(Note 1)

- 34th Fiscal Period

-

¥ 5,649

(From September 1, 2022 to February 28, 2023)

*Distribution payments start date is May 15, 2023. -

Forecast Distributions per Unit(Note 2)

- 35th period

-

¥ 5,600

(From March 1, 2023 to August 31, 2023)

- 36th period

-

¥ 5,600

(From September 1, 2023 to February 29, 2024)

- Distributions per unit for the fiscal period ended February 28, 2023 include distributions in excess of earnings of ¥795 (which do not apply to return of capital).

- Forecast distributions per unit are as of April 18, 2023, and actual distributions per unit may vary from the forecast. Furthermore, these forecasts do not guarantee the amount of distributions.

In addition, forecast distributions per unit include distributions in excess of earnings, and we forecast distributions in excess of earnings per unit of ¥802 (which do not apply to return of capital) for the fiscal period ending August 31, 2023 and ¥850 (including return of capital of ¥41) for the fiscal period ending February 29, 2024.

Distributions per Unit

Enlarge image

Operating Results

| Fiscal period ended August 31, 2022 |

Fiscal period ended February 28, 2023 |

|

|---|---|---|

| Operating revenues | ¥29,368million | ¥29,489million |

| Operating income | ¥12,661million | ¥12,740million |

| Net income | ¥11,049million | ¥11,123million |

-

- Asset size

(acquisition price basis) -

¥ 895.1 billion

- Asset size

-

- Period-end occupancy rate

-

99.7 %

-

- LTV

(excluding goodwill) -

44.9 %

- LTV

-

- Credit rating

-

JCR: AA (Stable)R&I: AA- (Stable)

Portfolio

Highlights

Summary

-

- Number of properties

-

230 properties

-

- Asset size

(acquisition price basis) -

¥ 897.5 billion

- Asset size

-

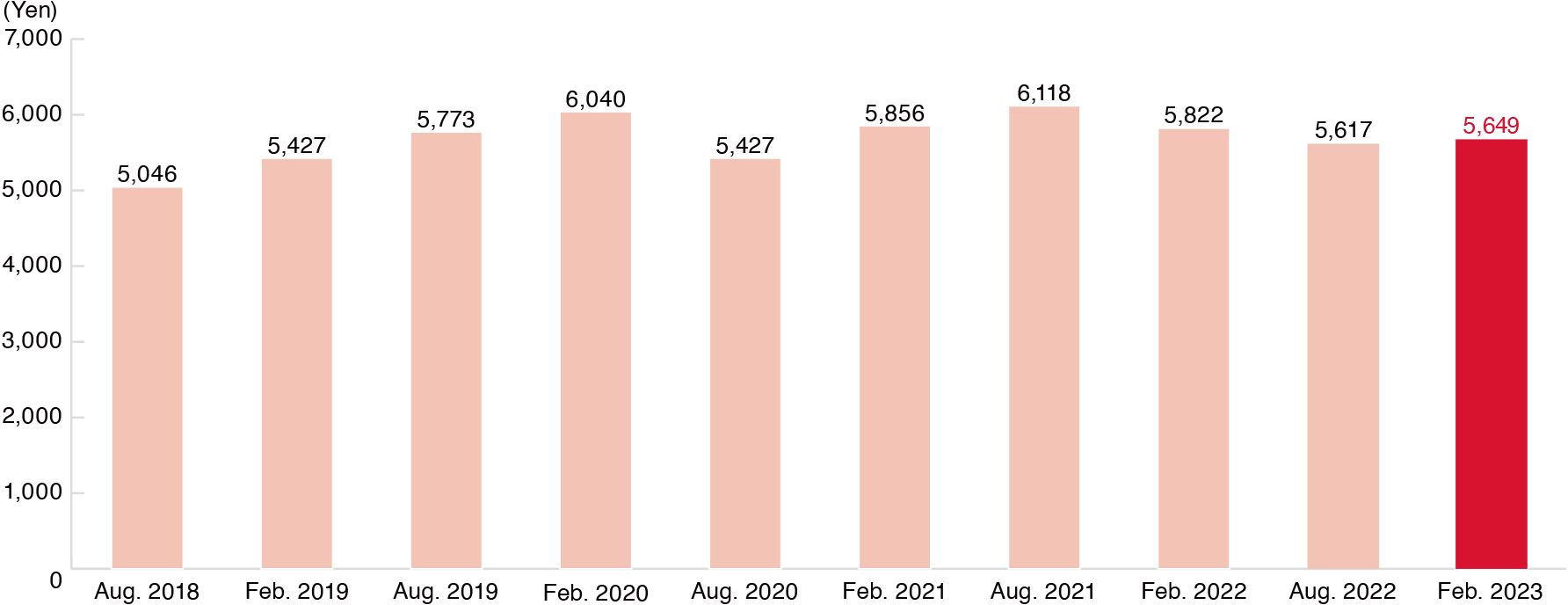

- Logistics

- 66 properties ¥ 470.1 billion

-

- Residential

- 129 properties ¥ 240.3 billion

-

- Retail

- 23 properties ¥ 123.2 billion

-

- Hotel

- 6 properties ¥ 22.2 billion

-

- Other assets

- 6 properties ¥ 41.6 billion

By asset class

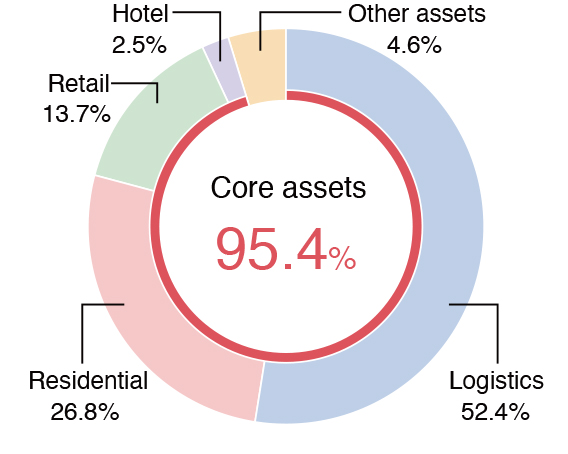

By area

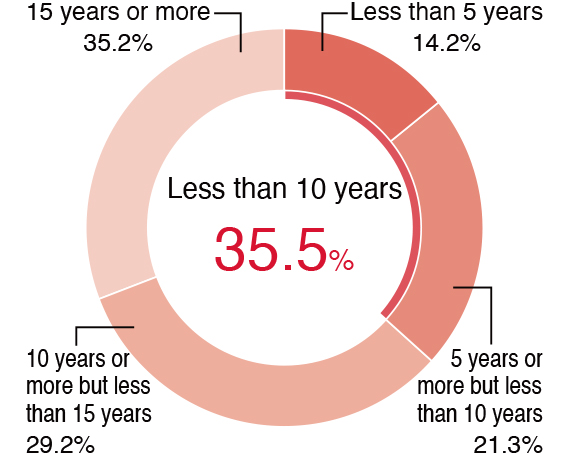

By property age

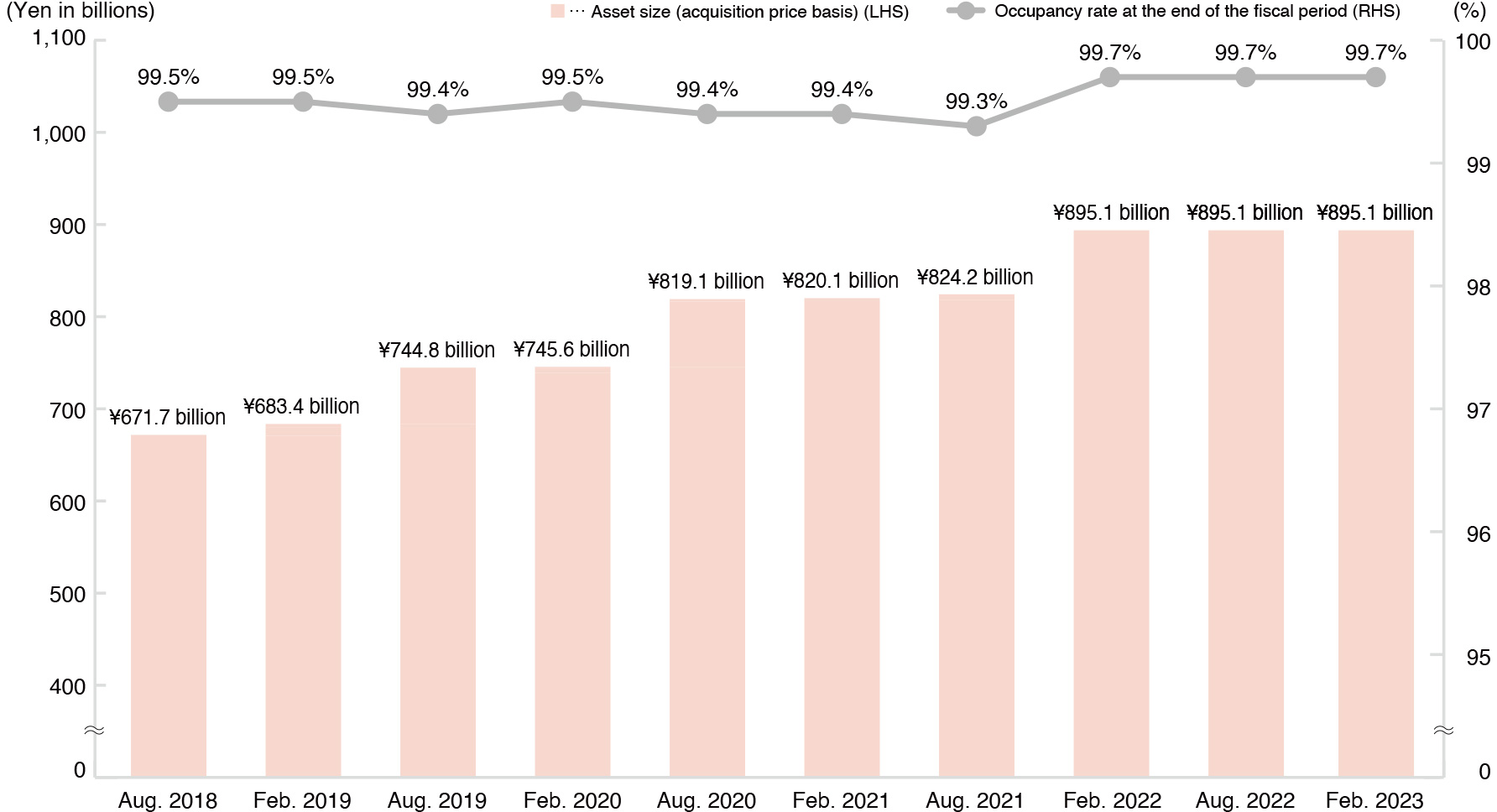

Trends of Asset Size (Acquisition Price Basis) and Occupancy Rate at the End of the Fiscal Period

Enlarge image

Initiatives to Pursue Growth

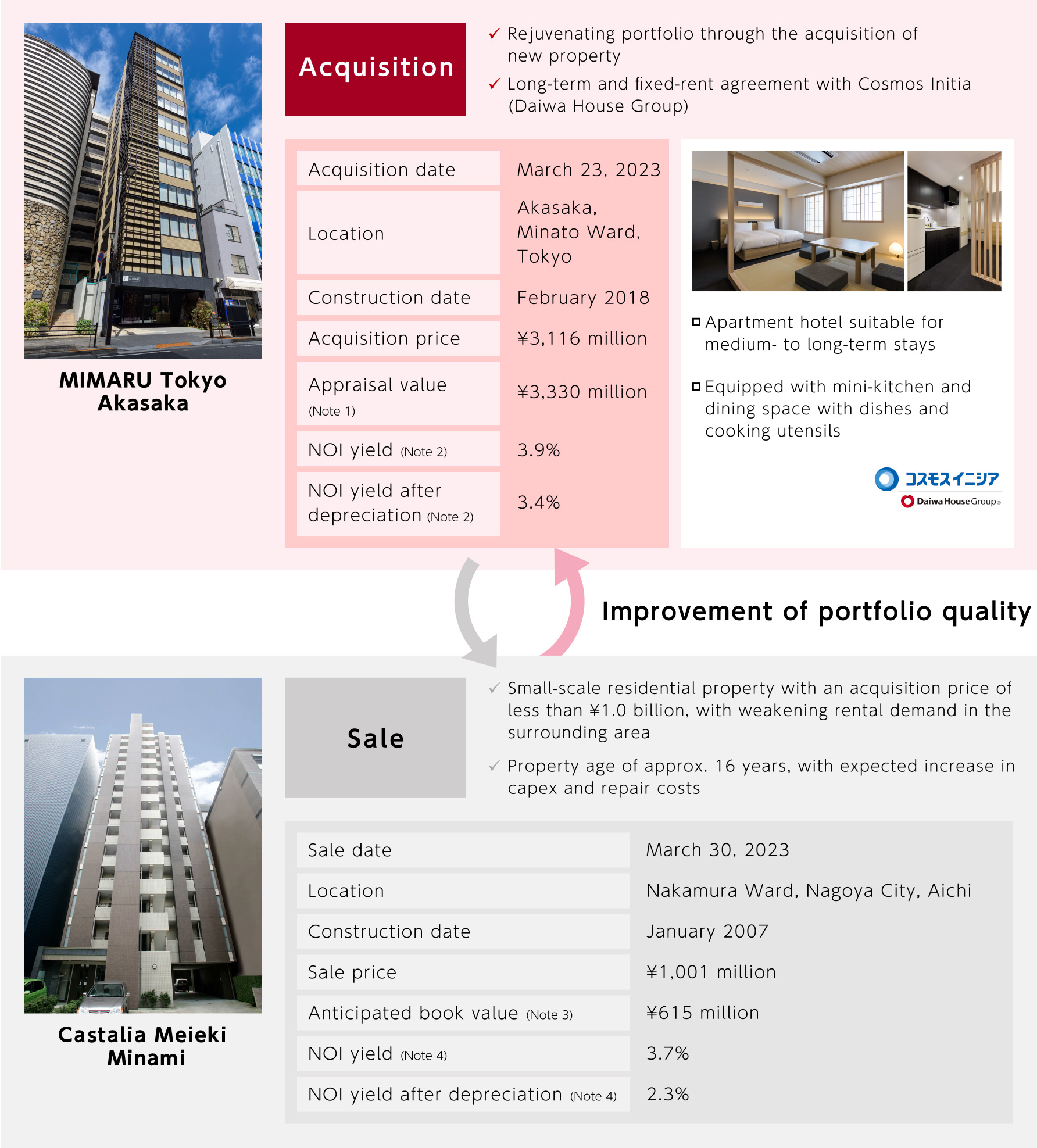

Property Replacement (March 2023)

- Utilizing sponsor support, acquired a hotel in Akasaka, a prime location in Minato Ward

- Recording gain of ¥349 million on the sale of a small-scale residential property in Nagoya City

Enlarge image

- "Appraisal value" of the acquired property is as of February 28, 2023.

- "NOI yield" of the acquired property is calculated by dividing the Net Operating Income (NOI) based on a direct capitalization method in the appraisal report by an acquisition price, and "NOI yield after depreciation" is calculated by dividing the figure, calculated by deducting depreciation estimated by the Asset Manager from the NOI as described above, by an acquisition price.

- "Anticipated book value" of the sold property is as of the sale date.

- "NOI yield" and "NOI yield after depreciation" of the sold property are calculated by dividing the annualized actual NOI and NOI after depreciation for the period ended February 28, 2023 by the sale price.

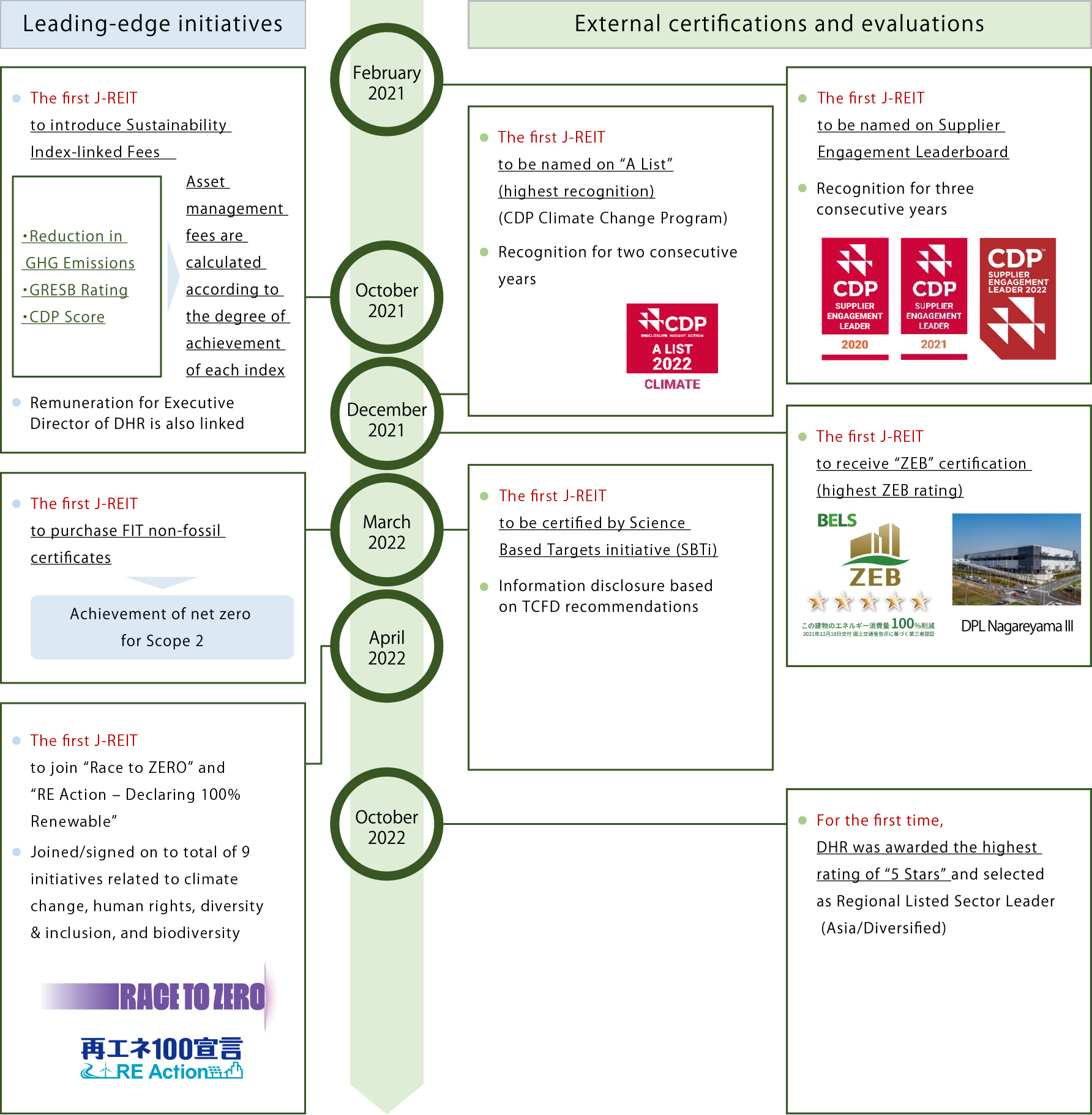

ESG Initiatives

Leading-edge ESG Initiatives

- Obtained external certifications and evaluations as the first J-REIT, and engaged in leading-edge ESG initiatives

Enlarge image

- In chronological order of the date of announcements

Initiatives Looking Ahead of ESG Trend (1)

- Obtained an external evaluation regarding human capital, a new ESG theme, in addition to major domestic and foreign external evaluations

CDP Climate Change Program

- Evaluation of initiatives and information disclosure on climate change issues

(Evaluation by CDP which runs the world's environmental disclosure system) - Awarded the highest score of "A" and certified as a Climate Change "A List" company for two consecutive years

(2022 CDP Climate Change Program) - Named as the only J-REIT to the "Supplier Engagement Leaderboard," the highest rating, for three consecutive years

(2022 CDP Supplier Engagement Rating)

ESG Finance Awards Japan

- Evaluation of information disclosure on environmental issues

(Established by the Ministry of the Environment to promote ESG finance) - Became the first J-REIT awarded as an "Environmentally Sustainable Company" meeting certain standards in terms of disclosure quality

Certified Health & Productivity Management Outstanding Organization Recognition Program

(Asset Manager)

- Certification program of corporations that practice excellent health and productivity management

(Promoted by the Ministry of Economy, Trade and Industry and Nippon Kenko Kaigi) - Certified as one of the "Bright 500," the top 500 corporations in the "2023 Health & Productivity Management Outstanding Organizations (SME category)"

Initiatives Looking Ahead of ESG Trend (2)

- Expanded the theme from climate change to natural resources and responded proactively

Joining the biodiversity initiatives as the first asset manager of J-REIT

Japan Business Initiative for Biodiversity (JBIB)

- JBIB is a group of Japanese corporations actively working to conserve biodiversity, and aims to contribute to the conservation of biodiversity in Japan and abroad by promoting joint research among various corporations to produce results that cannot be achieved by a single corporation

30 by 30 Alliance for Biodiversity

- 30 by 30 is an initiative to halt the loss of biodiversity and put it on a recovery track (nature positive) by 2030. The goal is to effectively conserve at least 30% of land and sea as healthy ecosystems by 2030

- 30 by 30 Alliance for Biodiversity is a coalition of volunteers to promote efforts to achieve this goal

Biodiversity certification obtained for properties owned by DHR

JHEP

- JHEP is the only certification system in Japan to objectively and quantitatively evaluate and certify the degree of contribution to biodiversity conservation

- Royal Parks Toyosu obtained an "A" rating for "conserving biodiversity through abundant planting" and "forming a network connecting greenery in urban areas"

ABINC

- ABINC is a certification system to evaluate and certify biodiversity-friendly initiatives based on the "Promotion Guidelines for ABINC" developed by JBIB

- Royal Parks Hanakoganei was highly evaluated for "maintaining a diverse environment with a set of trees, grassland and waterfront areas, and relatively large trees" and "making consideration to rainwater cycle by placing a rain garden"

Initiatives Aimed at Social Contributions

Providing a place to hold a children's cafeteria (Castalia Meguro Kamurozaka)

- To make effective use of the space (about 65 m²) renovated from a meeting room to a party room, we consulted with Shinagawa Ward Council of Social Welfare and started providing the place to hold a children's cafeteria in December 2022

- The children's cafeteria is a social welfare activity that provides a warm social gathering place for the children and residents of the community, as well as inexpensive and nutritious meals

- We support local activities by acting as a bridge between local children and residents, and organizers of the children's cafeteria

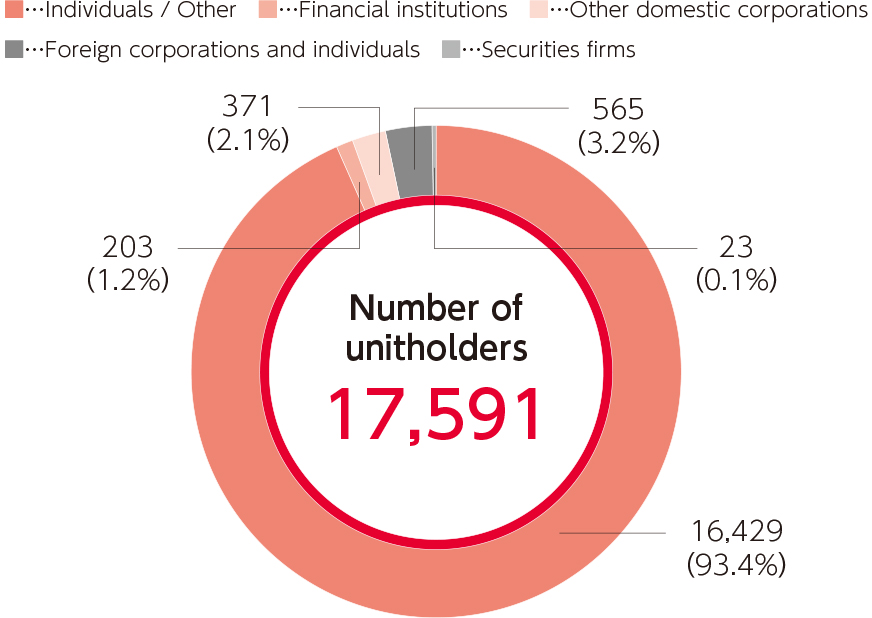

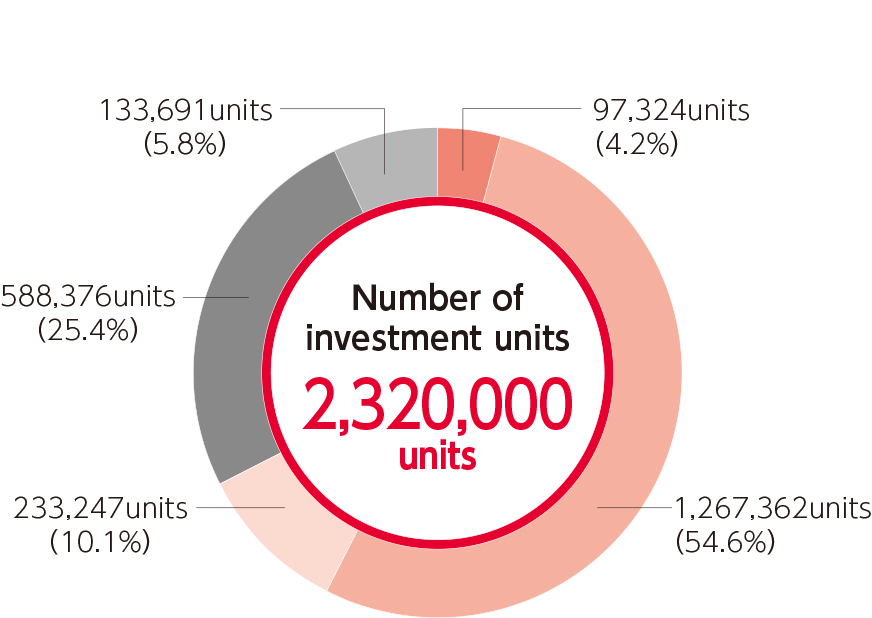

Investor Information

Unitholders Data

- Ratios in parentheses are rounded to the nearest tenth.

Outline of the Asset Manager

| Corporate Name | Daiwa House Asset Management Co., Ltd. |

|---|---|

| Location | 7th Floor, Nissei Nagatacho Building, 2-4-8, Nagatacho, Chiyoda-ku, Tokyo 100-0014 |

| Established | September 1, 2004 |

| Paid-in Capital | ¥300 million |

| Shareholder | Daiwa House Industry Co., Ltd. (100%) |

Note for Unitholders

| Account closing date | Last day of February and August of each year |

|---|---|

| Date for determining distribution payments | Last day of February and August of each year (Distributions are to be paid within three months of each date.) |

| Unitholders' Meeting | To be held at least once every two years |

| Date for finalizing general meeting voting rights |

Date set forth in Section 16.1 in the Articles of Incorporation by DHR |

| Listing | REIT section of the Tokyo Stock Exchange (Securities code: 8984) |

| Public notices | The "Nikkei" newspaper (Nihon Keizai Shimbun) |

| Transfer agent | 4-1, Marunouchi 1-chome, Chiyoda-ku, Tokyo 100-8233, JAPAN Sumitomo Mitsui Trust Bank, Limited |

| Inquiries |

8-4, Izumi 2-chome, Suginami-ku, Tokyo 168-0063, JAPAN Stock Transfer Agency Business Planning Dept. of Sumitomo Mitsui Trust Bank, Limited TEL: 0120-782-031 (toll-free, available within Japan only) Weekdays 9 a.m. to 5 p.m. |

Abolition of Unitholder Benefit Program

DHR abolished the unitholder benefit program applicable for Daiwa Royal Hotels and Royton Sapporo effective from the fiscal period ended February 28, 2023 due to the transfer of shares of the operating company, Daiwa Resort Co., Ltd. We sincerely appreciate your understanding.

For details, please refer to the DHR press release "Notice Concerning Abolition of Unitholder Benefit Program" dated February 3, 2023.

Procedures for Changes of Address, etc.

Please submit changes of address, name, etc., to your securities company, etc. For procedures regarding investment units registered in special accounts, please contact: Stock Transfer Agency Business Planning Dept. of Sumitomo Mitsui Trust Bank, Limited.

Receipt of Distributions

You can receive distributions when you bring your receipt for distributions to the local office of the Japan Post Bank in Japan or to a post office (bank agent). If the period for receiving distributions has elapsed, please contact the transfer agent Sumitomo Mitsui Trust Bank, Limited.

If you would like to specify an account to which future distributions will be transferred, please follow the procedures of your securities company, etc.

We will not pay and have no obligation to pay cash distributions not claimed within three years of the distribution date, as stipulated in our Articles of Incorporation. Please receive your distributions as soon as possible.

Distribution Statement

The "Distribution Statement" delivered upon payment of distributions includes the "Payment Notice," referred to in the provisions of the Act on Special Measures Concerning Taxation. This document may be used as a document when declaring income for tax purposes. However, for unitholders who have selected the system of dividend allotment to securities company accounts in proportion to the number of shares held, the amount of withholding tax will be calculated by your securities company, etc. For supporting documents when declaring income for tax purposes, please confirm with your securities company, etc. Furthermore, unitholders who receive distributions by way of a receipt for distributions also receive a "Distribution Statement" enclosed with it.

Outline of the Social Security and Tax Number System Nicknamed "My Number System" with Regard to Investment Units

Residents in Japan are notified of their Social Security and Tax Number (nicknamed "My Number") by their city, town or village. My Number is required when performing tax-related procedures with regard to investment units.

Use of the My Number for Investment Unit Related Business

As stipulated by laws and regulations, it is now required to state the My Number of the unitholder on payment records that are submitted to the tax office. Unitholders are therefore requested to submit their My Number to their securities company, etc.

[Contact address for inquiries on submitting My Number]

- Unitholders whose investment units are managed by a securities account

Please direct your inquiries to your securities company, etc. - Unitholders not conducting transactions via a securities company

Please call the following toll-free phone number.

Stock Transfer Agency Business Planning Dept. of Sumitomo Mitsui Trust Bank, Limited

TEL: 0120-782-031