Highlights

Financial Highlights

Key Indicators for the 12th FP

As of June 30, 2023

| Statement of Income Data (million yen) | 11th FP | 12th FP (June 30, 2023) |

||

|---|---|---|---|---|

| Actual | Forecast@ Feb.15, 2023 |

Actual | Increase / (Decrease) (vs Forecast) |

|

| Operating revenues | 3,715 | 3,690 | 3,452 | (238) |

| Operating income | 1,383 | 1,352 | 1,156 | (196) |

| Income before income taxes | 1,214 | 1,149 | 1,003 | (145) |

| Net income | 1,213 | 1,148 | 1,003 | (144) |

| Distribution per unit (including distributions in excess of earnings) |

3,750 yen | 3,750 yen | 3,750 yen | - |

| Distributions per unit (excluding distributions in excess of earnings) |

3,138 yen | 2,969 yen | 2,595 yen | (374) yen |

| Distributions in excess of earnings per unit | 612 yen | 781 yen | 1,155 yen | 374 yen |

-

- CO2 Reduction (12th FP)

- 39,397,574 kg-co2

-

- CO2 Reduction (From Oct 2017 to Jun 2023)

- 399,035,057 kg-co2

-

- # of Projects

- 25 PV Facilities

-

- Total Acquisition Price

- JPY 800.0 bin

-

- Panel Output of AUM

- 183.9 MW

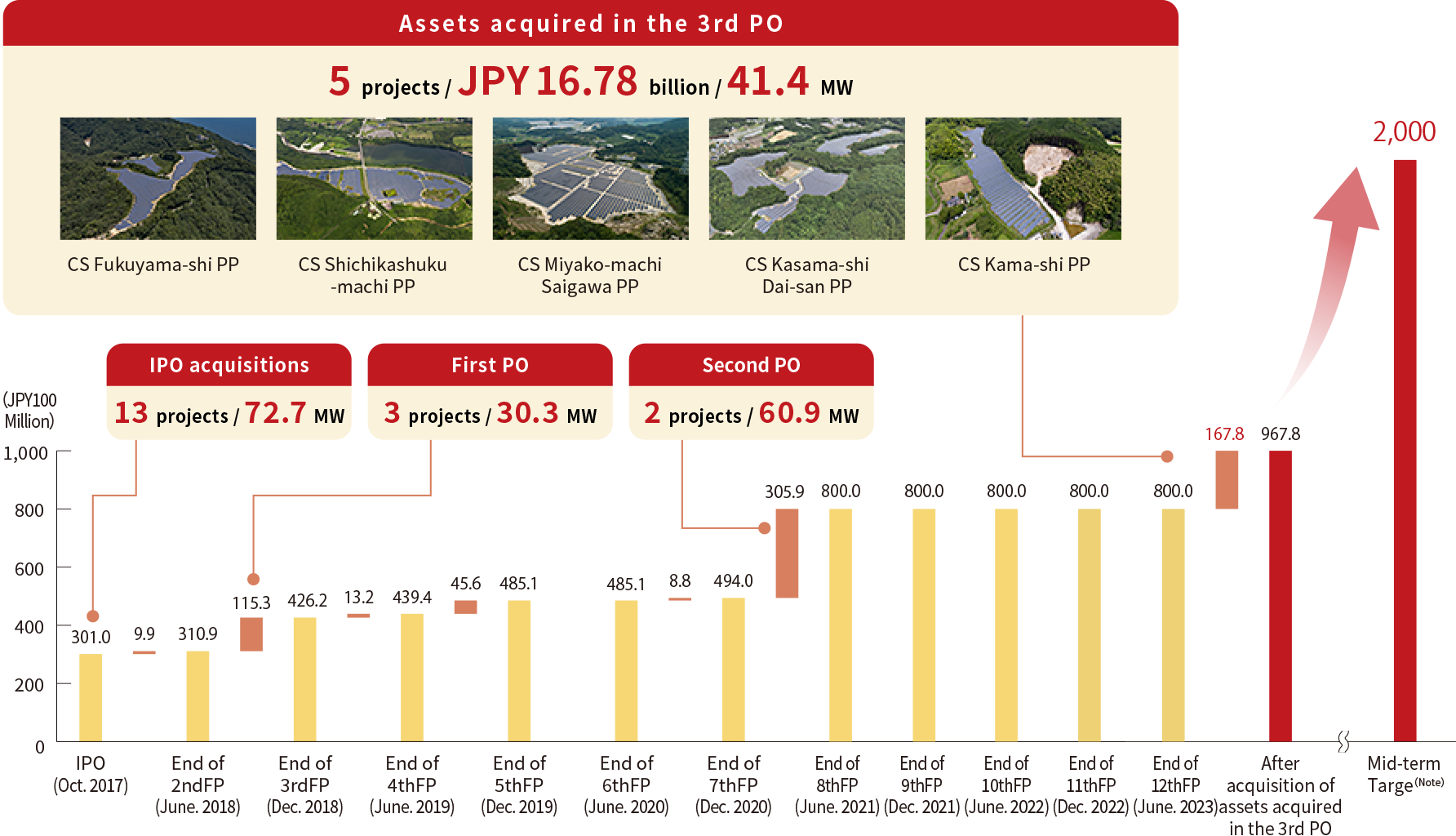

Track Record of Consistent External Growth

CSIF continues to aim for growth with a new mid-term target of JPY 200 billion yen in asset size, while diversifying its portfolio with a focus on solar power plants, of which the Canadian Solar Group has expertise

Track Record of Consistent External Growth and Target of asset size (acquisition price basis)

Enlarge image

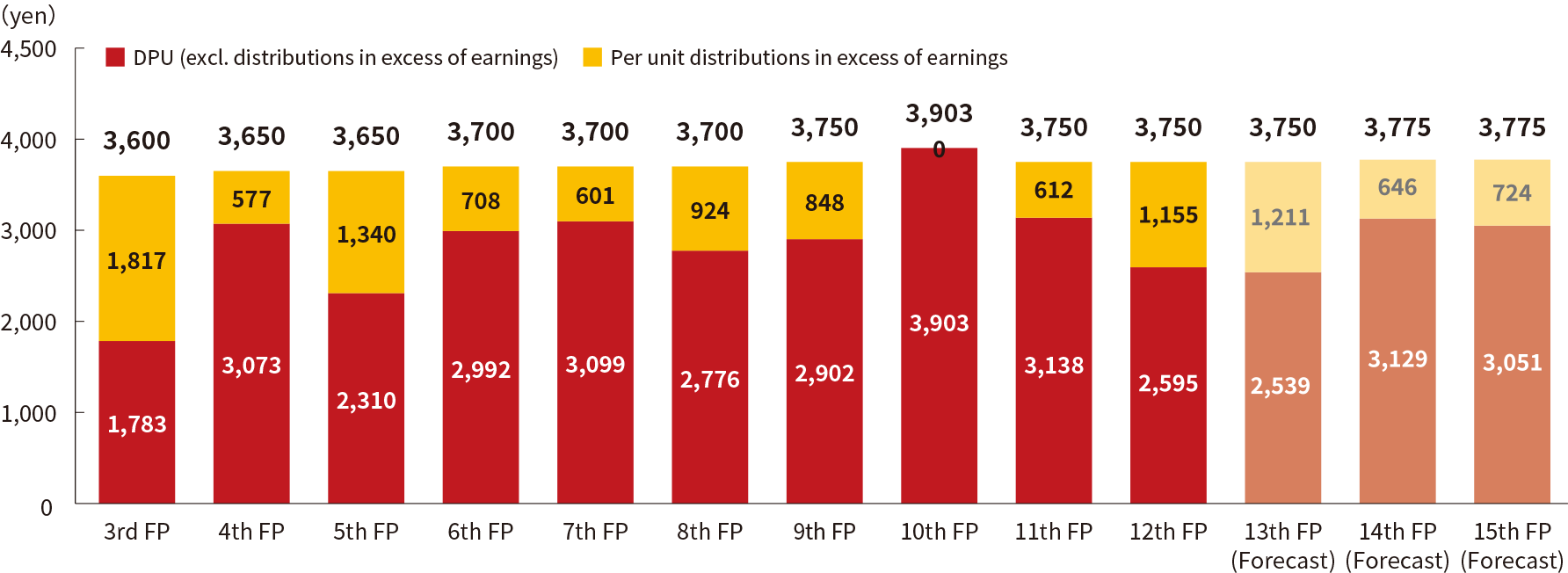

Historical and Forecasted Dividend

Since its listing, CSIF has offered a stable dividend and achieved steady increases in dividends.

Enlarge image