In the 11th fiscal period, the frequency of output curtailment decreased significantly year on year, and the negative impact on energy output was mitigated. However, operating revenue fell short of the initial forecast due to lower-than-expected actual energy output as a result of fewer hours of sunlight compared to the forecast because of generally poor weather conditions throughout the period. In terms of operating expenses, the large increase in repair expenses was not able to be offset by the decrease in professional fees, and operating income also fell short of the initial forecast. On the other hand, ordinary income and net income exceeded the initial forecasts due to the posting of a large amount of insurance income received as non-operating income. Ultimately, operating revenue was 3,715 million yen, operating income was 1,383 million yen, ordinary income was 1,214 million yen, and net income was 1,213 million yen. Given that net income exceeded the initial forecast by 23 million yen, profit distributions per unit increased 61 yen from the initial forecast to 3,138 yen. In addition, distributions in excess of earnings were reduced by the same amount, and dividends per unit were set at 3,750 yen, the same amount as the initial forecast.

Special Feature

Management Interview

What was CSIF’s management performance in the 11th fiscal period?

One year has passed since the start of Russia’s invasion of Ukraine. Please describe any impact this had had on asset management due to changes in the market environment, such as the subsequent surge in resource prices, exchange rate fluctuations and market interest rates.

The impact of Russia’s invasion of Ukraine in February 2022 included an increase in the cost of thermal power generation due to soaring energy resource prices, higher electricity prices, and the impact on the composition of power sources. However, there has been little impact on CSIF’s operating results up to this point. The reason for this is that there is no direct impact on operating revenue as the electricity prices of the power plants held by CSIF are fixed based on the Feed-in Tariff system. Similarly, there was also little impact from the perspective of cost, as most expenses are fixed or are not directly affected by foreign exchange fluctuations. Moreover, the rise in market interest rates has not had any impact on CSIF’s interest-bearing debt, as 100% of the debt is currently financed at fixed interest rates. As just described, we believe that CSIF’s asset management is immune to changes in the macro environment.

What are your recent initiatives for ESG?

Since its establishment in 2017, CSIF, together with its asset manager Canadian Solar Asset Management K.K. (CSAM), has practiced ESG-conscious asset management. In conducting our business, we recognize that the problem of climate change is an important management issue that can be a risk or an opportunity. In addition to CSAM’s signing of the United Nations Principles for Responsible Investment (UN PRI) in August 2019 and its endorsement of the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) in February 2022, we have recently published our ESG Report in February 2023. In the ESG Report, we have selected ESG issues (“materiality”) of particular importance to CSIF to promote our efforts for achieving our goals and further improving our initiatives by setting KPIs for materiality items and implementing specific measures through our future activities.

Please describe the latest trends in the institutional aspects surrounding renewable energy.

- Among the important institutional changes that have been discussed, the situation regarding producer-side charges has changed recently. The producer-side charges are a system under which, for the purpose of maintaining and managing the power transmission and distribution network, a portion (10%) of the consignment charge that was previously paid entirely by retail operators will also be borne by power generators, including those from renewable energy sources, in proportion to the scale of power generation. The system was initially expected to be finalized within fiscal year 2021 and begin operating in fiscal year 2023, but in November 2021, the 6th Basic Energy Plan stated, “discussions will continue concerning the need for such treatment,” and decided to postpone the system design by one year. Subsequently, the Subcommittee on Mass Introduction of Renewable Energy and Next-Generation Electricity Networks, which met in November 2022, proposed to proceed with consideration of “adjusting by levy or exempting the application of already certified FIT/FIP projects, while taking into account the burden on the public.” Finally, at its meeting on December 2022, the Subcommittee proposed that “already approved FIT/FIP projects will be completely exempted during the FIT period.” After public comments, the details of these projects are expected to be finalized by March 2023, and they are scheduled to begin operating in fiscal year 2024. If this decision is finalized, the uncertainty in terms of CSIF’s future operations will be resolved, as the additional cost burden that had been a concern will be eliminated during the FIT period.

Canadian Solar Group

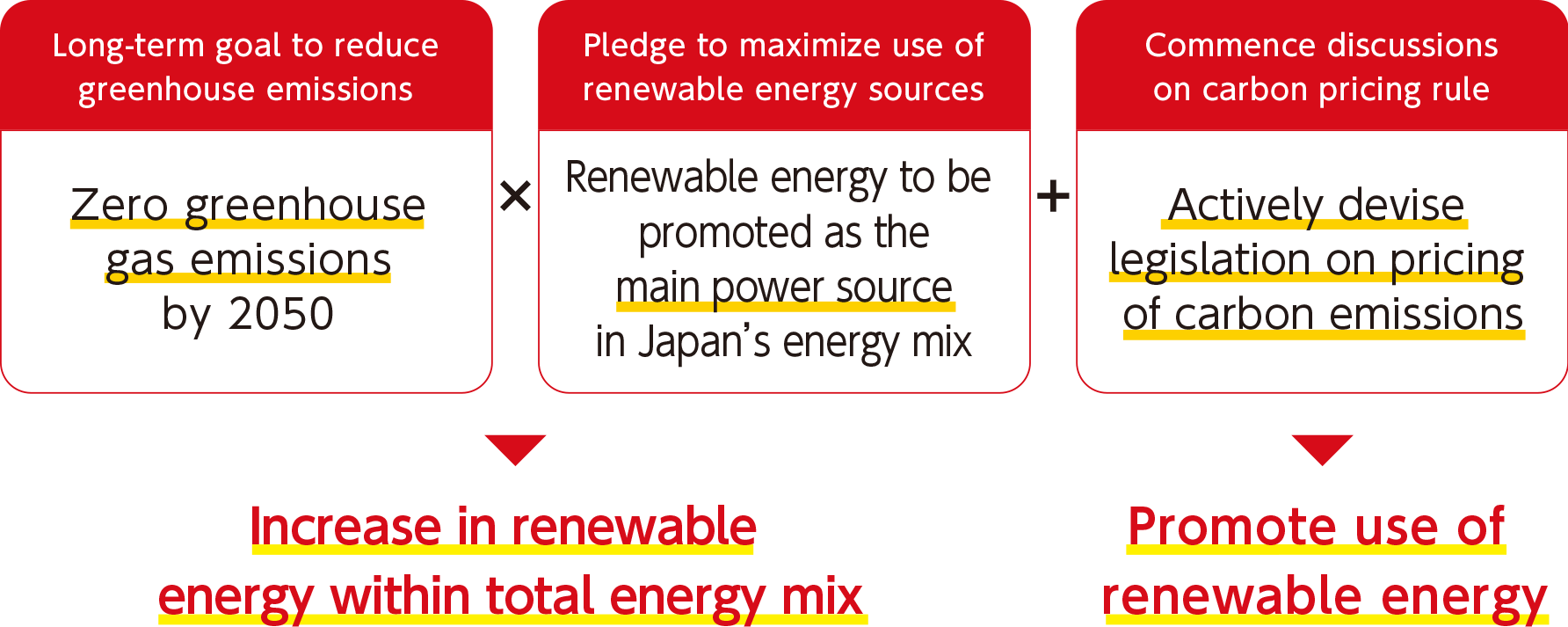

PM Suga in October of 2020 set a target to achieve zero greenhouse gas emissions by 2050 in his general policy speech.

Given the policies and forecasts released by the Japanese government, CSIF believes that renewable energy may make up a larger portion of the supply of electricity generated in Japan.

Enlarge image

Aiming to Achieve Carbon Neutrality

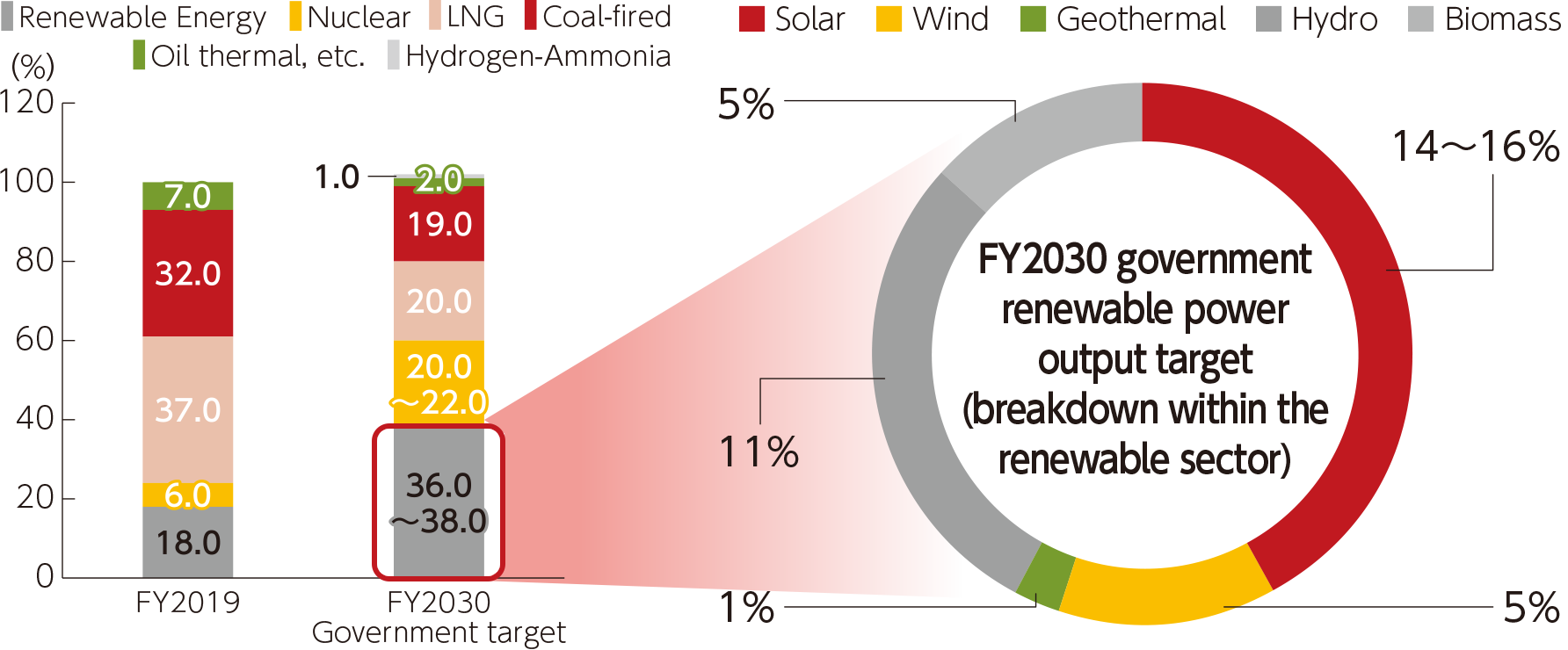

In the 6th Basic Energy Plan approved by the Cabinet in October 2021, it was stated that “based on the basic premise of S+3E(Note), we will thoroughly make renewable energy the main source of power, work on the principle of giving top priority to renewable energy, and maximize the introduction of renewable energy while curbing the burden on the public and coexisting with local communities. The government’s target power source ratio for 2030 is expected to be 36-38%, with solar power accounting for the largest share at 14-16%. The government’s target of renewable energy for 2030 is 36-38% of the total power supply, with solar power accounting for the largest share at 14-16%, so the role of solar power will be important for the time being.

(Note)The acronym stands for Safety, Energy Security, Economic Society, and Environment.

Ratio of Renewable Energy in total Energy Mix Target : 36~38%

Solar power is expected to compose 14%~16% of the total renewable energy mix

Enlarge image

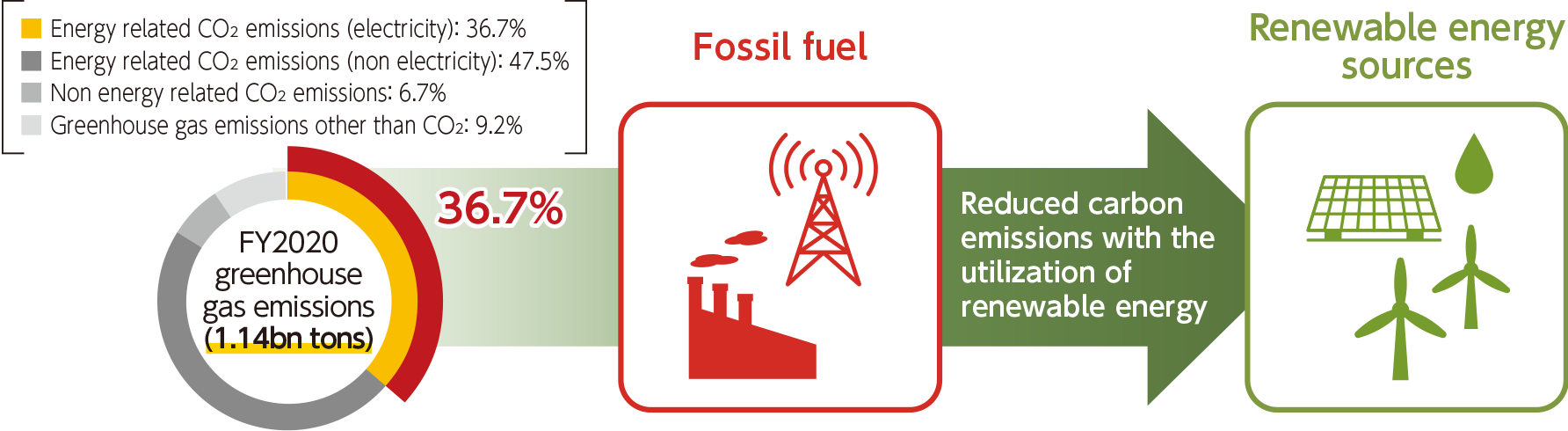

Breakdown of greenhouse gas emissions in Japan(Note)

Carbon emissions from electricity production makes up 35.7% of total carbon emissions in Japan, and the introduction and wider use of renewable energy are expected to contribute towards lowering Japan’s carbon emissions.

Enlarge image

Based on the judgment that it is essential to conduct a comprehensive review of the regulations that serve as barriers to this process, and to promote the necessary regulatory review and expedite the review process, the government established the “Task Force for Comprehensive Review of Regulations Concerning Renewable Energy, etc.” in November 2020 in order to achieve such regulatory reform with a sense of speed. Many requests for deregulation and removal of regulations have been submitted and studies have begun in the areas of(1)location restrictions, (2)grid regulations, (3)market restrictions, (4)coexistence with local communities, and(5)others.

ESG finance and Japan’s carbon neutrality policies

Investments and loans made by taking into account not only conventional financial information but also non-financial information, comprising environmental, social and governance factors, are called ESG finance. ESG finance has attracted worldwide attention and in the last several years has been expanding dramatically in Japan. Needless to say, ESG finance has had a favorable impact on investments in investment units offered by the Investment Corporation, loans from banks and the issuance of green bonds.

As ESG finance evolves and expands both in terms of quality and volume, moves to respond to the initiatives of the Task Force on Climate-related Financial Disclosures (TCFD) and other opportunities for similar disclosure as well as “100% renewable” (RE100) and net carbon zero target setting are becoming increasingly active among global companies and issuing entities. In other words, investors and banks are positively evaluating these ESG initiatives, while businesses also have become keenly aware of these initiatives as means to improve corporate value.

In Japan, since Prime Minister Yoshihide Suga made a policy speech in October 2020 on the establishment of goals for reducing greenhouse gas emissions and achieving carbon neutrality by 2050, the Japanese government has been accelerating initiatives toward post-carbon society.

In circumstances where new currents are emerging, some forward-thinking global enterprises are now asking their business partners to set emission reduction targets, conduct renewable energy procurement, etc. Initiatives to achieve the post-carbon society are shaping corporate management strategies and leading to the creation of new business opportunities.