Highlights

Financial Highlights

Key Indicators for the 11th FP

December 31, 2022

| Statement of Income Data (million yen) | 10th FP | 11th FP (ended Dec. 2022) | ||

|---|---|---|---|---|

| Actual | Forecast@ Aug.16, 2022 |

Actual | Increase / (Decrease) (vs Forecast) |

|

| Operating revenues | 4,060 | 3,725 | 3,715 | (10) |

| Operating income | 1,743 | 1,404 | 1,383 | (21) |

| Income before income taxes | 1,509 | 1,190 | 1,214 | 23 |

| Net income | 1,509 | 1,189 | 1,213 | 23 |

| Distribution per unit (including distributions in excess of earnings) | 3,903 yen | 3,750 yen | 3,750 yen | - |

| Distributions per unit (excluding distributions in excess of earnings) | 3,903 yen | 3,077 yen | 3,138 yen | 61 yen |

| Distributions in excess of earnings per unit | - | 673 yen | 612 yen | (61) yen |

-

- CO2 Reduction (10th FP)

- 42,834,862 kg-co2

-

- CO2 Reduction (cumulative) Oct.2017–Jun.2022

- 359,637,483 kg-co2

-

- # of Projects

- 25 PV Facilities

-

- Total Acquisition Price

- JPY 800.0 bin

-

- Panel Output of AUM

- 183.9 MW

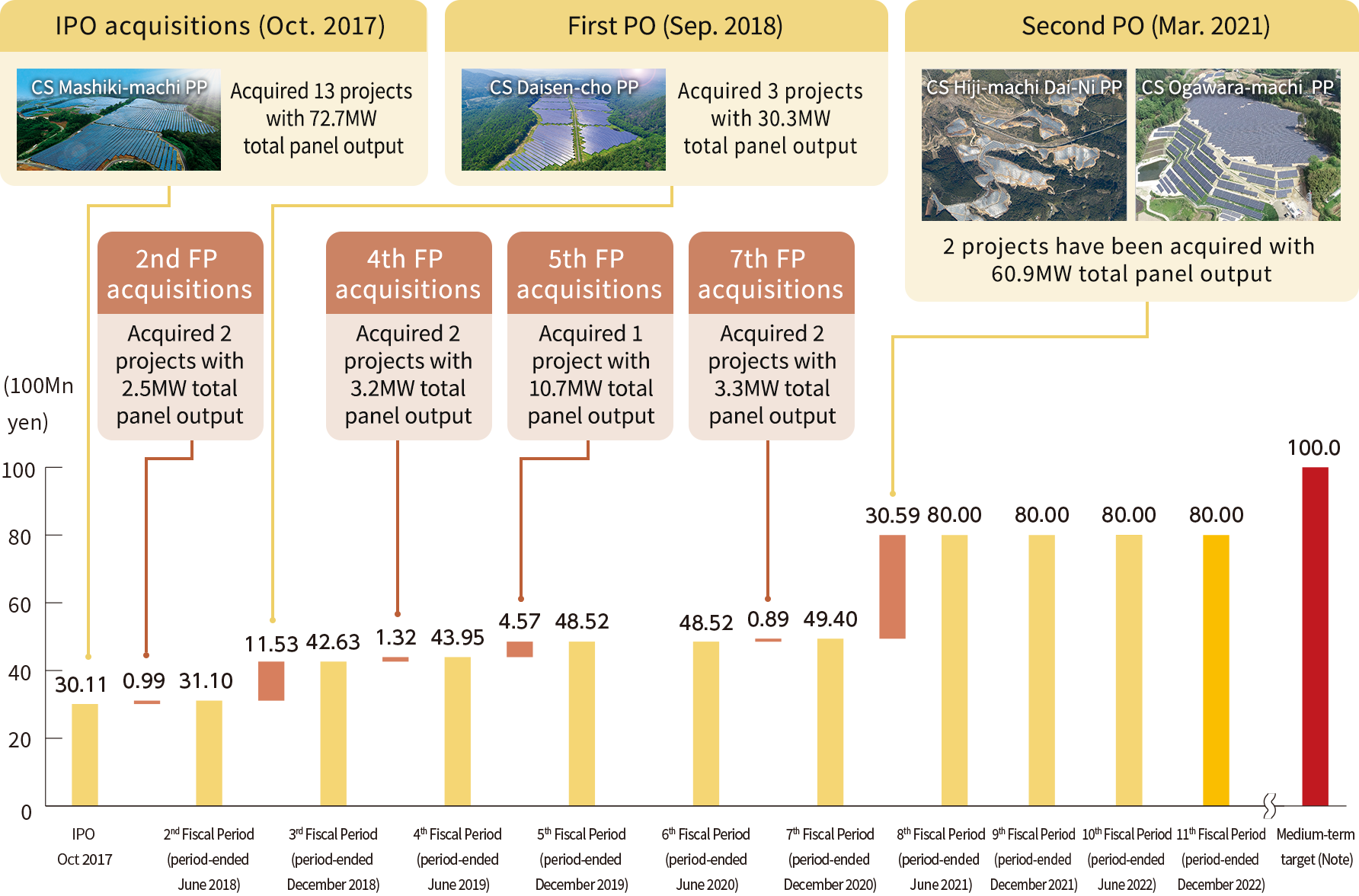

Track Record of Consistent External Growth

CSIF has achieved continuous growth in asset size by sourcing projects mainly from the abundant sponsor pipeline.

CSIF held ¥80.0bn (acquisition value base) as of the end of the 11th FP, making it the largest player in the listed infrastructure fund market.

CSIF will continue to lead the market as the largest listed infrastructure fund by asset size.

Track Record of Consistent External Growth (acquisition price basis)

Enlarge image

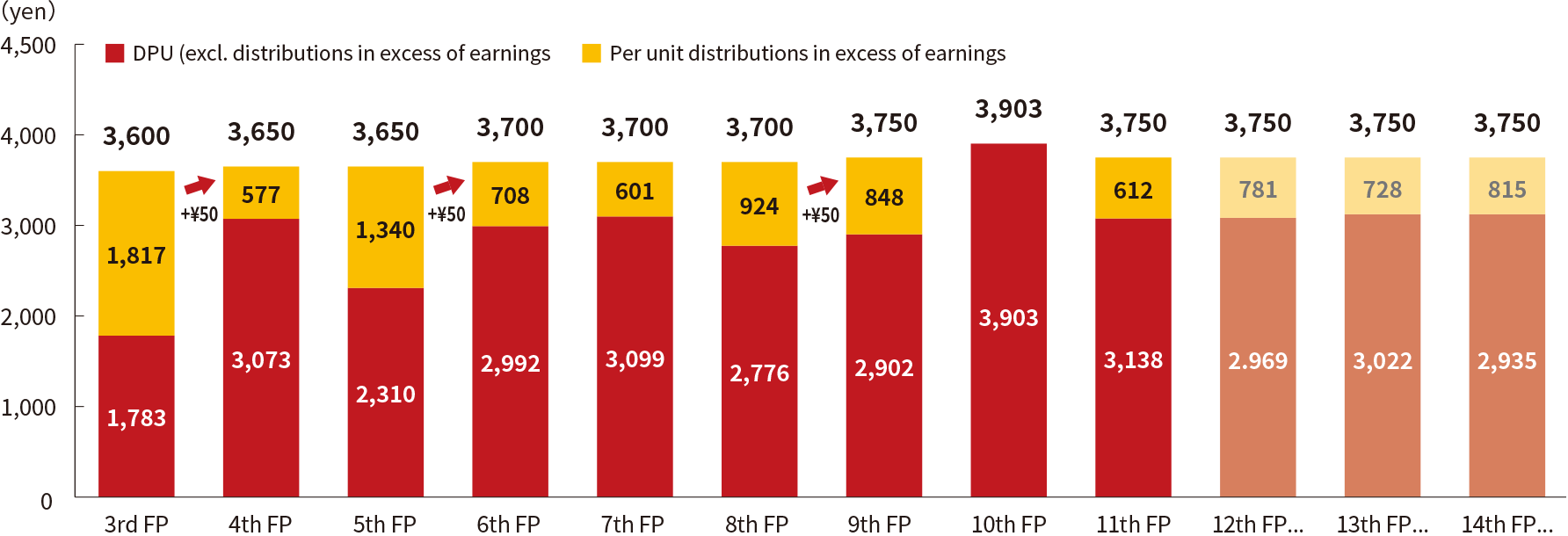

Historical and Forecasted Dividend

Since its listing, CSIF has offered a stable dividend and achieved steady increases in dividends.

Enlarge image