Special Feature

Management Interview

What was CSIF’s management performance in the 13th fiscal period?

The weather was generally stable throughout the 13th fiscal period. Output curtailment was implemented to a certain extent mainly at power plants under unlimited output rules in Kyushu Electric Power jurisdiction, but the overall impact was limited. As a result, actual energy output was 100.81%, slightly higher than projected, and operating revenue was higher than initially forecast. Operating expenses were lower than initially forecast due to a certain degree of cost control, mainly through a decline in construction costs compared to the budget and a decrease in depreciation. In non-operating incomes and expenses, we reduced investment unit issuing expenses at the time of raising capital through the public offering in July and decreased interest expenses and borrowing-related expenses for borrowings by using variable interest rates. As a result, ordinary income exceeded the initial forecast. Ultimately, operating revenue was 4,537 million yen, operating income was 1,846 million yen, ordinary income was 1,386 million yen, and net income was 1,385 million yen. As a result, profit distributions per unit increased 528 yen from the initial forecast, to 3,067 yen. Distributions in excess of earnings were decreased by 528 yen, the same amount as the increase in profit distributions per unit, and the total dividend per unit was set at 3,750 yen, the same amount as the initial forecast.

Output curtailment can be said to have had a limited impact in the 13th fiscal period. What is the outlook for output curtailment and what impact will output curtailment have on your performance?

Although we instituted output curtailment to a certain extent in the 13th fiscal period, it had a limited impact on our overall performance compared with the 12th fiscal period in the first half of the year. The reason for this is that, in addition to the fact that the output curtailment was implemented in the second half of the year (July to December), it was limited mainly to power plants under the unlimited rules in the Kyushu Electric Power jurisdiction. 10 power plants, most of the power plants held by CSIF in the Kyushu Electric Power jurisdiction as of the end of the 13th fiscal period, are under the 30-day rule, which sets the maximum number of days of output curtailment at 30 days a year (April to March in the following year), and the number of days output curtailment implemented in April through June 2023 is approaching 30 days. Regarding the 14th fiscal period, we believe that the impact on business results will be small compared to last year, given that there is little room to implement output curtailment until the end of fiscal 2023 (March 2024).

In addition, government initiatives to reduce curtailment of renewable energy power output are underway. In May 2023, METI’s Power Grid Working Group proposed measures such as (i) a reduction of minimum output for newly constructed thermal power plants from the current 50% to 30%, and (ii) wide-area output curtailment operation. At the Mass Renewable Energy Introduction / Next Generation Energy Network Committee in June 2023, under the basic policy of reducing curtailment of renewable energy power output, experts agreed to compile new countermeasure packages for the reduction of curtailment of renewable energy power output within 2023 after broadly discussing possible actions to be taken each for supply, demand and grid. In the Committee, a new “Countermeasure Package to Reduce the Curtailment of Renewable Energy” was compiled in December 2023 to investigate the curtailment of renewable energy in more detail. As for specific measures, multiple items have been proposed for each of demand measures, supply measures, and grid measures. Based on the above, we expect that the impact of output curtailment will be mitigated in the next fiscal year onwards compared to the current fiscal year.

Tell us about your growth outlook and future initiatives.

Since the listing, CSIF has been working to expand the asset size by mainly acquiring assets from the pipeline, centered on projects developed by the sponsor, and set a new medium-term target of 200 billion yen last year, aiming for further growth. To increase our asset size to 200 billion yen, we intend to achieve sourcing route diversification by accelerating acquisitions of third-party developed assets in addition to acquisitions from our abundant sponsor pipeline. Currently, the total number of properties in the sponsor-developed assets is 19 with 345.8 MW, and if 2 properties with 47.0 MW developed by third parties are added, the total number of properties in the pipeline will be 21 with 392.8 MW, which exceeds the asset size at the end of the 12th fiscal period and a sufficient scale compared to the current panel output of 226.4 MW. Among these, CS Azuma Kofuji Solar Power Plant, which was the sponsor’s largest development project and was among Japan’s largest projects, was transferred to a bridge fund at the end of May 2023. Canadian Solar Asset Management K.K. (CSAM), which is CSIF’s asset manager, concluded a basic agreement with the bridge fund under which CSAM holds preferential negotiating rights to acquire the asset in the future. Three other properties are also included in bridge funds, and we plan to sequentially acquire them as the next acquisition targets, in preference to other properties that are already in operation. The advantages of using a bridge fund include that this enables (i) adjustment of mismatches between the desired timing of transactions between the seller and CSIF and (ii) allows CSIF to control the number of assets acquired and the scale of acquisitions and to make asset acquisitions more flexibly. As just described, we will aim to achieve stable external growth by diversifying property acquisition routes and acquisition methods.

What is your outlook for distributions in the future?

Since it started to pay distributions per unit of 3,600 yen in the third fiscal period after the listing, CSIF has offered stable distributions and achieved steady increases in distributions. In addition, distributions per unit are expected to be 3,775 yen, the fourth increase in distributions, in the 14th fiscal period party due to the contribution of property acquisition at the time of capital increase through the public offering in July 2023. As a breakdown, the rate of increase in profit distributions is expected to rise significantly. With the aim of growing while maintaining stable distributions, CSIF will continue to increase profit distributions per unit (EPU) for each event such as a property acquisition in order to raise the proportion of EPU in distributions per unit and reduce distributions in excess of earnings.

To Carbon Neutrality

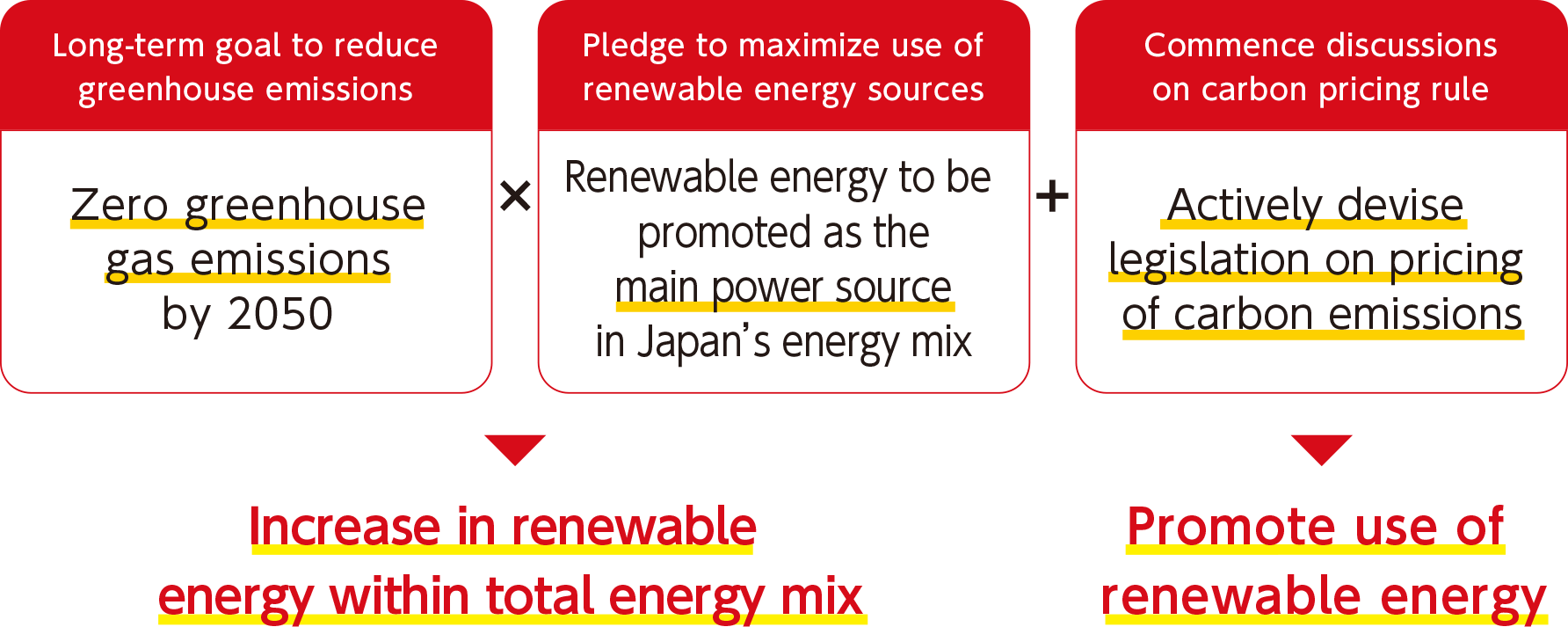

PM Suga in October of 2020 set a target to achieve zero greenhouse gas emissions by 2050 in his general policy speech. Given the policies and forecasts released by the Japanese government, CSIF believes that renewable energy may make up a larger portion of the supply of electricity generated in Japan.

Enlarge image

Aiming to Achieve Carbon Neutrality

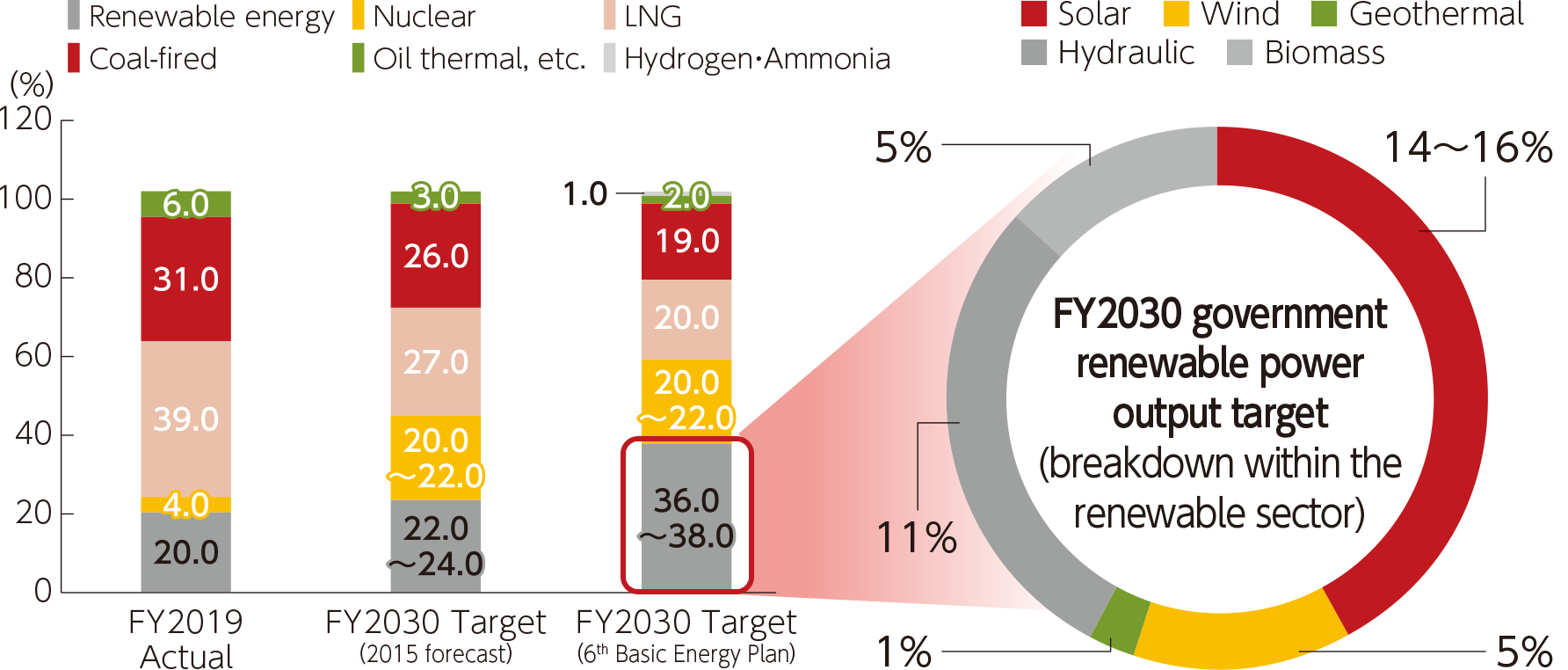

In the 6th Basic Energy Plan approved by the Cabinet in October 2021, it was stated that “based on the basic premise of S+3E(Note), we will thoroughly make renewable energy the main source of power, work on the principle of giving top priority to renewable energy, and maximize the introduction of renewable energy while curbing the burden on the public and coexisting with local communities. The government’s target power source ratio for 2030 is expected to be 36-38%, with solar power accounting for the largest share at 14-16%. The government’s target of renewable energy for 2030 is 36-38% of the total power supply, with solar power accounting for the largest share at 14-16%, so the role of solar power will be important for the time being.

(Note)The acronym stands for Safety, Energy Security, Economic Society, and Environment.

Ratio of Renewable Energy in total Energy Mix Target : 36~38%

Solar power is expected to compose 14%~16% of the total renewable energy mix

Enlarge image

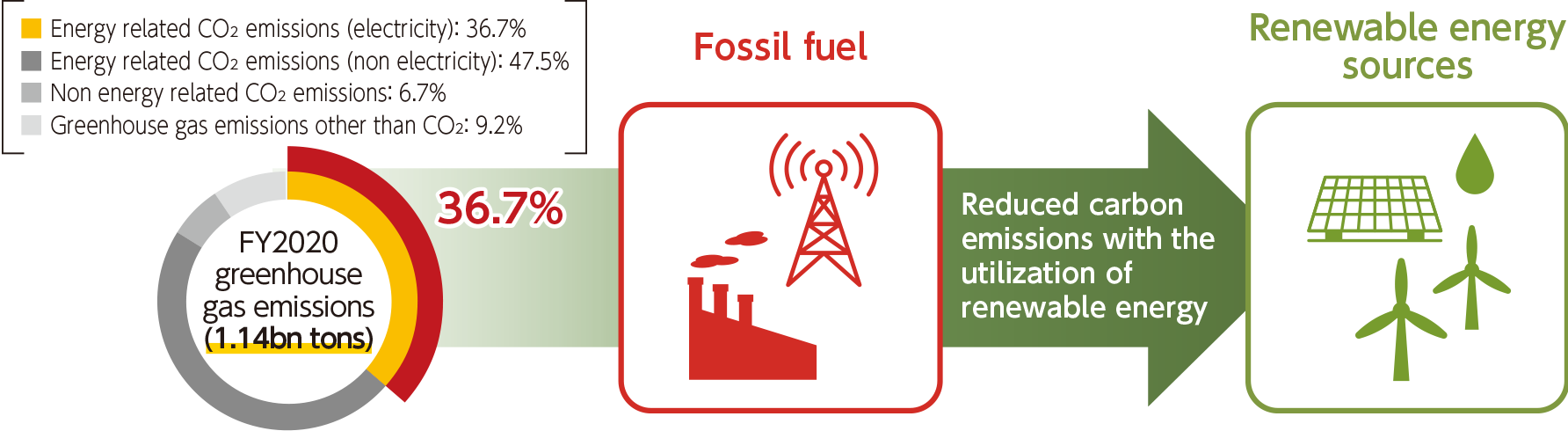

Breakdown of greenhouse gas emissions in Japan

Carbon emissions from electricity production makes up 35.7% of total carbon emissions in Japan, and the introduction and wider use of renewable energy are expected to contribute towards lowering Japan’s carbon emissions.

Enlarge image

Based on the judgment that it is essential to conduct a comprehensive review of the regulations that serve as barriers to this process, and to promote the necessary regulatory review and expedite the review process, the government established the “Task Force for Comprehensive Review of Regulations Concerning Renewable Energy, etc.” in November 2020 in order to achieve such regulatory reform with a sense of speed. Many requests for deregulation and removal of regulations have been submitted and studies have begun in the areas of(1)location restrictions, (2)grid regulations, (3)market restrictions, (4)coexistence with local communities, and(5)others.

ESG finance and Japan’s carbon neutrality policies

Investments and loans made by taking into account not only conventional financial information but also non-financial information, comprising environmental, social and governance factors, are called ESG finance. ESG finance has attracted worldwide attention and in the last several years has been expanding dramatically in Japan. Needless to say, ESG finance has had a favorable impact on investments in investment units offered by the Investment Corporation, loans from banks and the issuance of green bonds.

As ESG finance evolves and expands both in terms of quality and volume, moves to respond to the initiatives of the Task Force on Climate-related Financial Disclosures (TCFD) and other opportunities for similar disclosure as well as “100% renewable” (RE100) and net carbon zero target setting are becoming increasingly active among global companies and issuing entities. In other words, investors and banks are positively evaluating these ESG initiatives, while businesses also have become keenly aware of these initiatives as means to improve corporate value.

In Japan, since Prime Minister Yoshihide Suga made a policy speech in October 2020 on the establishment of goals for reducing greenhouse gas emissions and achieving carbon neutrality by 2050, the Japanese government has been accelerating initiatives toward post-carbon society.

In circumstances where new currents are emerging, some forward-thinking global enterprises are now asking their business partners to set emission reduction targets, conduct renewable energy procurement, etc. Initiatives to achieve the post-carbon society are shaping corporate management strategies and leading to the creation of new business opportunities.