Growth policy

External Growth Strategy

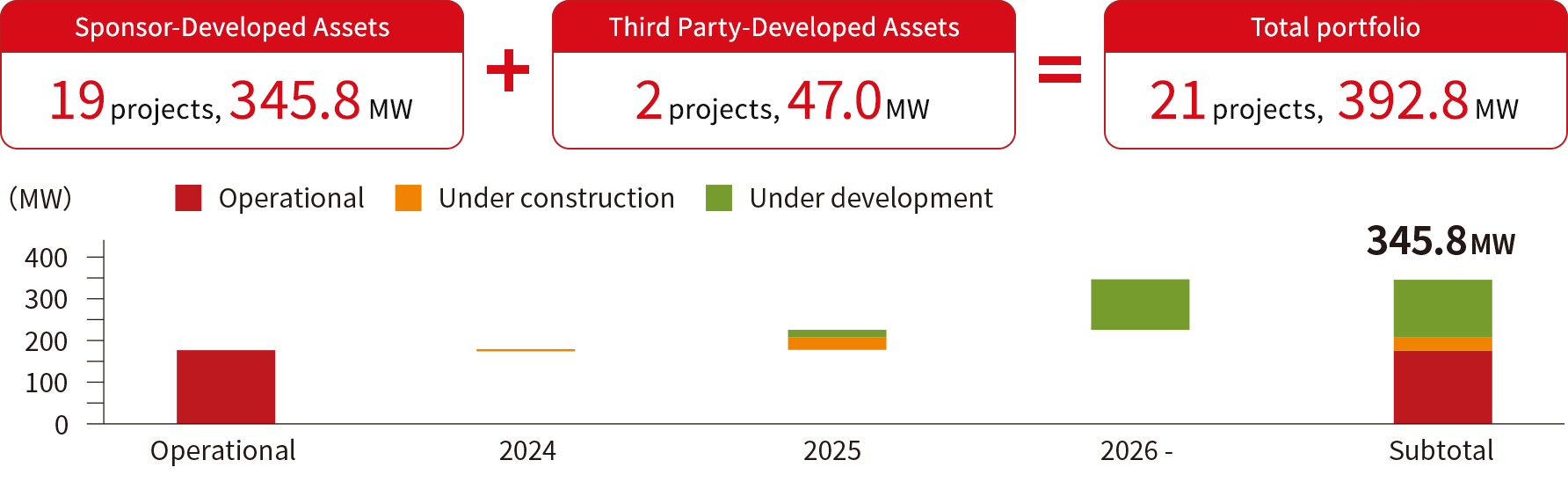

Operational Start Year and Status of Sponsor Portfolio Assets

Target to achieve ¥200 Bn in asset size in the medium term by accelerating acquisitions of third-party development projects, in addition to acquisitions from abundant sponsor pipeline

Enlarge image

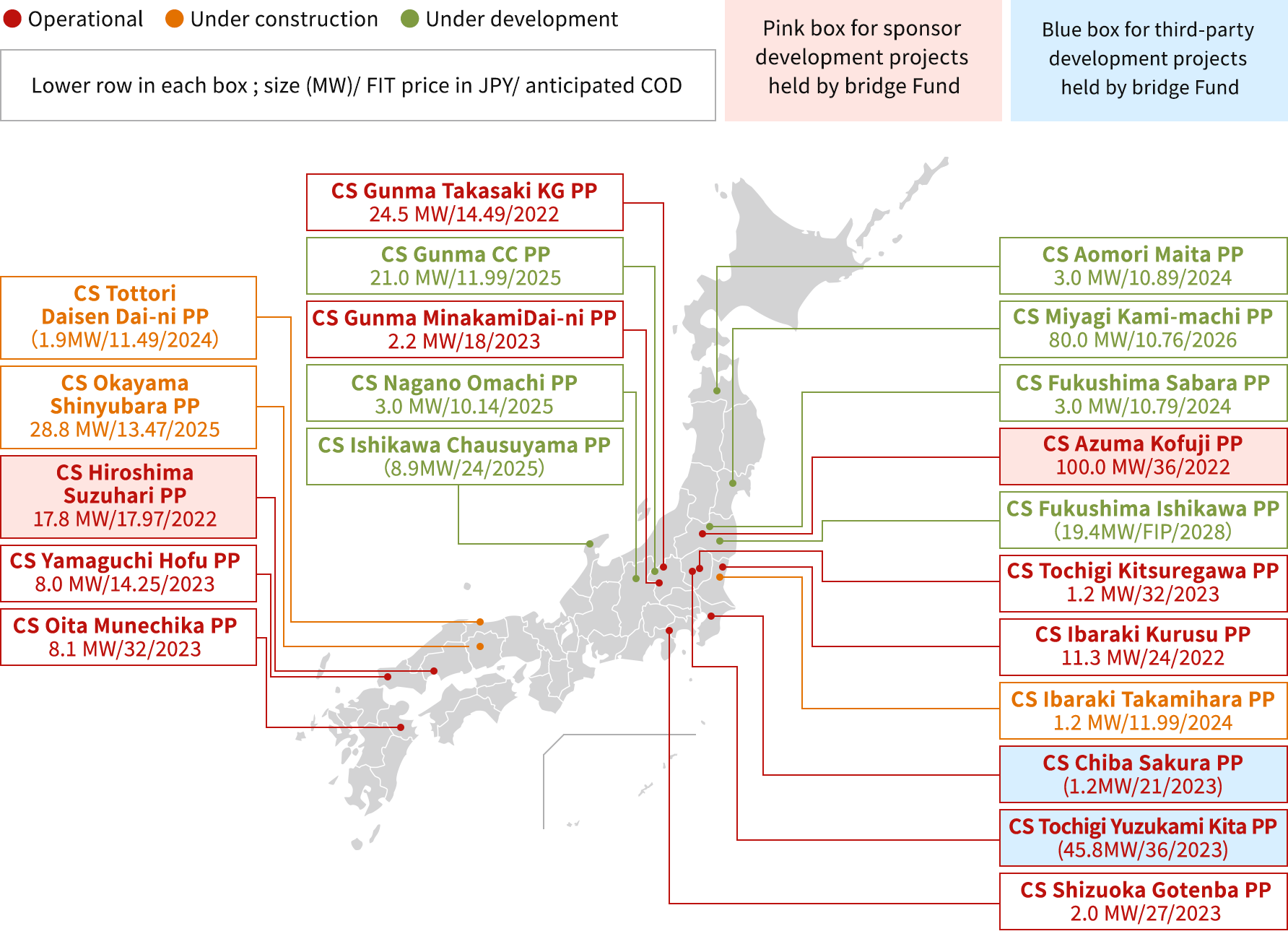

Abundant Pipeline Centered on Sponsor-Developed Assets Assisting CSIF’s Growth

as of December 31, 2023 : the third-party development assets are as of the date of the announcement of these financial results.

Enlarge image

Enterprising assets acquisition from third parties

While we focus on acquiring solar energy projects from our Sponsor pipeline, we aim to diversify our acquisition opportunities not only by utilizing bridge funds but also by securing acquisition routes from third parties with Asset Manager’s network.

Initiatives for Internal Growth

Tracking information disclosure and expansion of demand for renewable energy

- In light of the rapidly increasing awareness of global efforts towards carbon neutrality amongst Japanese electricity consumers, CSIF will grant access to tracking information (key information on renewable Power Plant as specified in the FIT Non-Fossil Certificate) of CS Daisen-cho Power Plant (A), Daisen-cho Power Plant (B), and CS Marumori-machi Power Plant for electricity consumers.

- At the Electricity and Gas Strategic Policy Subcommittee held in December 2022, a proposal to raise the minimum price of renewable energy traded in the Non-Fossil Value Trading Market has been submitted for panel review. CSIF believes that the need for renewable energy trading is rising amongst consumers.

(Note) FIT Non-Fossil Certificates are certificates that represent the renewable energy value of electricity purchased on a feed-in tariff under the FIT system and traded on the non-fuel value trading market of the Japan Electric Power Exchange (hereinafter referred to as “JPEX”).

New Specific Wholesale contracts with Retail Electricity provider

- For the following Power Plants, CSIF has reviewed the existing specific wholesale contracts for premium electricity sales and concluded new specific wholesale contracts for renewable electricity and with retail electricity providers in April 2023 and June 2023.

- CSIF believes that it will contribute to the spread of renewable energy and at the same time, contribute to the realization of internal growth through the recording of additional rental income.

| Power Plant | Renewal Period/ Termination of contract |

Contract Date | Scheduled Start Date of Specific Wholesale |

|---|---|---|---|

| CS Hiji-machi Dai-ni PP | Renewal for 1 year after 2 years |

April 24, 2023 | July 1, 2023 |

| CS Mashiki-machi PP | June 30, 2023 | September 1, 2023 | |

| CS Izu-shi PP | June 30, 2023 | September 1, 2023 | |

| CS Ogawara-machi PP | June 30, 2023 | September 1, 2023 |