Operation Strategy

Canadian Solar Group

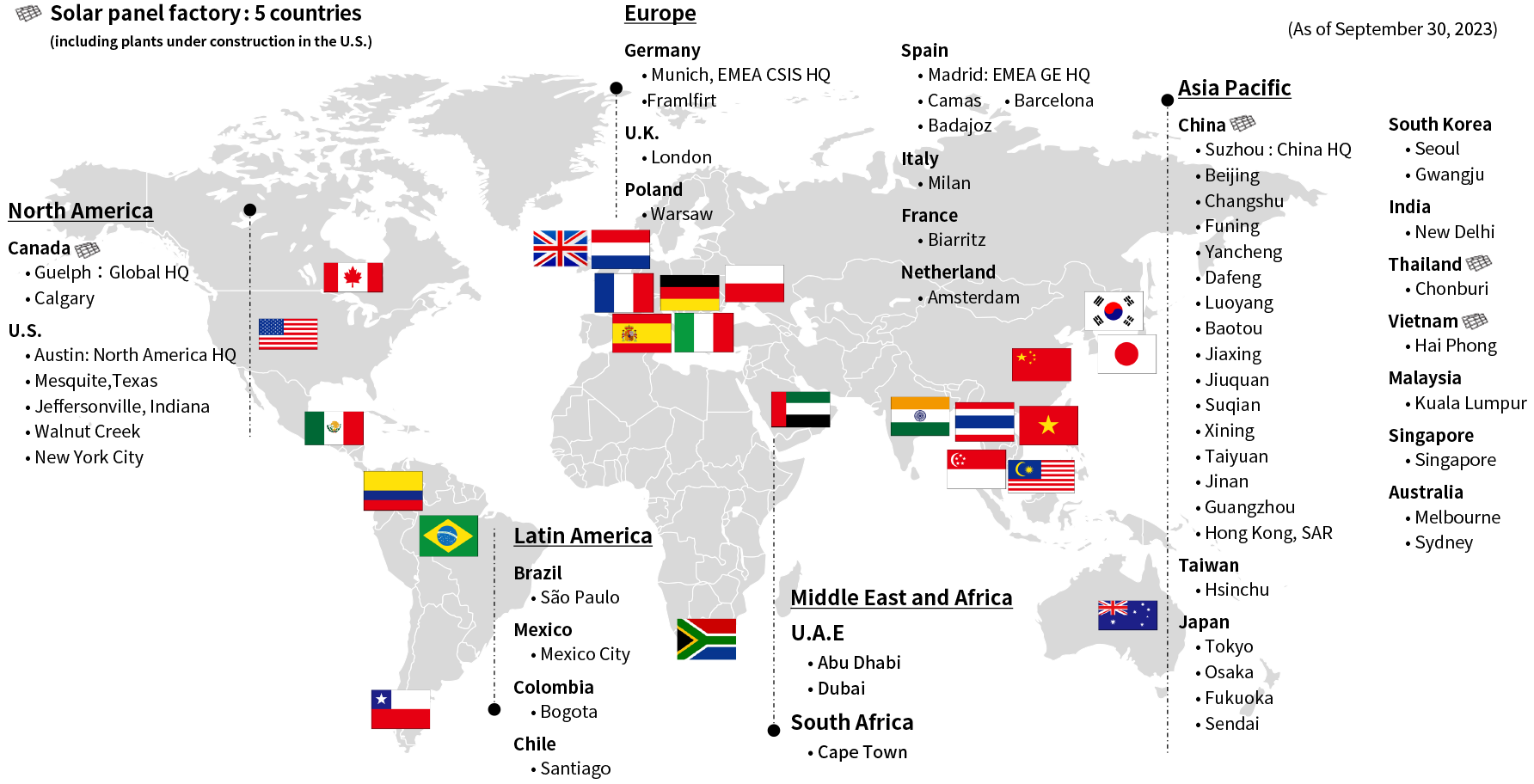

Canadian Solar Group, CSIF’s sponsor, is a global company engaged in the manufacturing and sale of solar panels etc, as well as the development and operation of solar power plants, It was established in Ontario, Canada in 2001 and has been listed on the NASDAQ stock exchange since 2006. The company had more than 20,000 employees in 24 countries and has annual sales of approximately $7.5 billion (approximately 1,120 billion yen at current exchange rates) for the fiscal year ending December 31, 2022. The group entered the Japanese market in 2009 and has been selling solar panels for residential and industrial uses. The sponsor has also been involved in the development of solar power plants since the early days of renewable energy, as the Feed-in Tariff system for solar power generation started in Japan in 2012.

Canadian Solar Group’s Global Operations

Enlarge image

Unique Aspects of the Fund

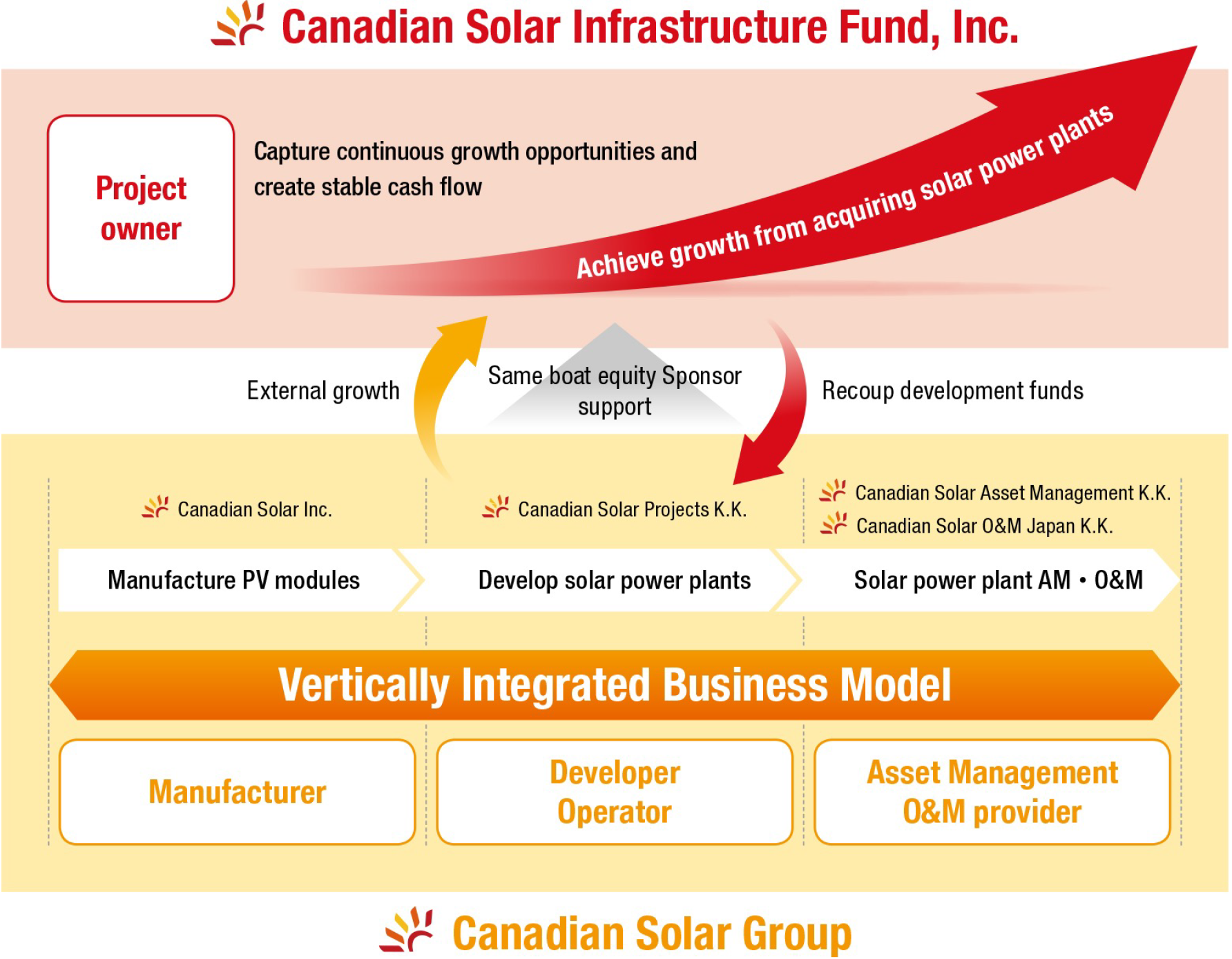

Advantageous Operation Based on the Vertically-Integrated Model of the Group

Prominent knowledge acquired by the Group as the total solution provider of solar power generation is fully utilized for the operation of CSIF. The uniqueness of the vertically integrated model of the group is shown as below.

The image of the value chain of renewable energy business at Canadian Solar Group

Enlarge image

Financial Strategy

CSIF has built a strong and stable financial base in accordance with a conservative financial strategy. In terms of key performance indicators, CSIF has kept LTV at an appropriate level and maintained a high fixed interest rate ratio. It has, therefore, hardly been impacted by the increases in market interest rates since last year.

Well-balanced stable debt finance

CSIF balances bank loans, usually with maturities of 10 years, with fund procurement from capital markets through the issuance of investment corporation bonds.

Currently, we have created a strong bank formation consisting of a total of 23 financial institutions, including five banks consisting of three megabanks as well as SBI Shinsei Bank and Sumitomo Mitsui Trust Bank as arrangers and co-arrangers, and we believe that we have established a financing structure for future asset expansion.

Financing from domestic and overseas investors

In the past three public offerings, including the IPO, CSIF has raised funds from both domestic and overseas investors through global offerings.In the third public offering, CSIF has raised funds through Domestic Offering, Rinpo Format, which is Transaction was documented by a Japanese language prospectus and an English language prospectus was not be prepared.

Financial Summary

Financial Summary

As of December 31, 2023

-

- Verage borrowing Interest

- 0.865 %

-

- DSCR(Note1)

- 2.12

-

- LTV(Note2)

- 52.59 %

-

- Fixed-to-variable interest rate ratio(Note3)

- 89.8 %

DSCR, or Debt Service Coverate Ratio is calculated as the sum of our operating income, depreciation costs and the increased portion of the reserves in our reserve fund for repair fees divided by the sum of our loans payable and interest expenses for the relevant fiscal period. DSCR is an operating measure to illustrate the ability to meet principal and interest payment obligations on existing loan payable.

Loan to value, or LTV is calculated as interest-bearing debt divided by total assets as of the end of the relevant fiscal period multiplied by 100.

“Fixed-to-variable interest rate ratio” refers to the ratio of fixed interest rate liabilities to total interest-bearing liabilities at that time. Variable interest rate liabilities that were converted to fixed interest rate liabilities through interest rate swap agreements were deemed as fixed interest rate liabilities.

Credit rating

CSIF is the only TSE-listed infrastructure fund rated by both of JCR and R&I as of June 30, 2023.

-

JCR:A(Stable) (As of August 17, 2023)

-

R&I:A-(Positive) (As of August 4, 2023)

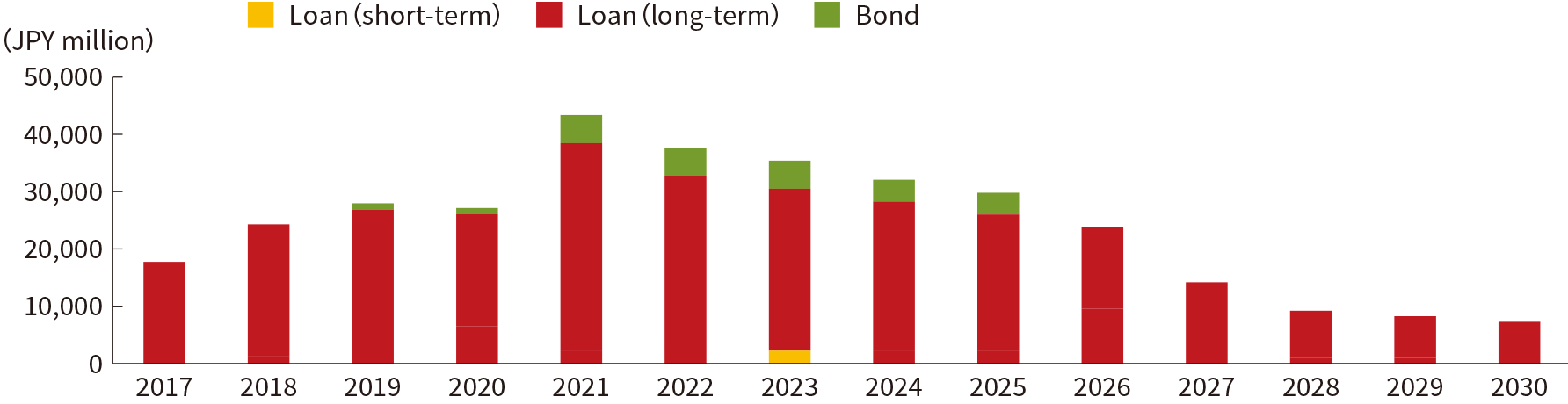

Historical Balance of Interest-bearing Debt

Enlarge image